This is not criticism. This is how strong teams diagnose the next growth constraint once the basics are working.

LastPass is still a serious product. And if you're reading this thinking "here comes another teardown," let me stop you there. This isn't about a broken product. It's about something more nuanced and more common than most teams want to admit: the moment when your product works, but your positioning and packaging don't.

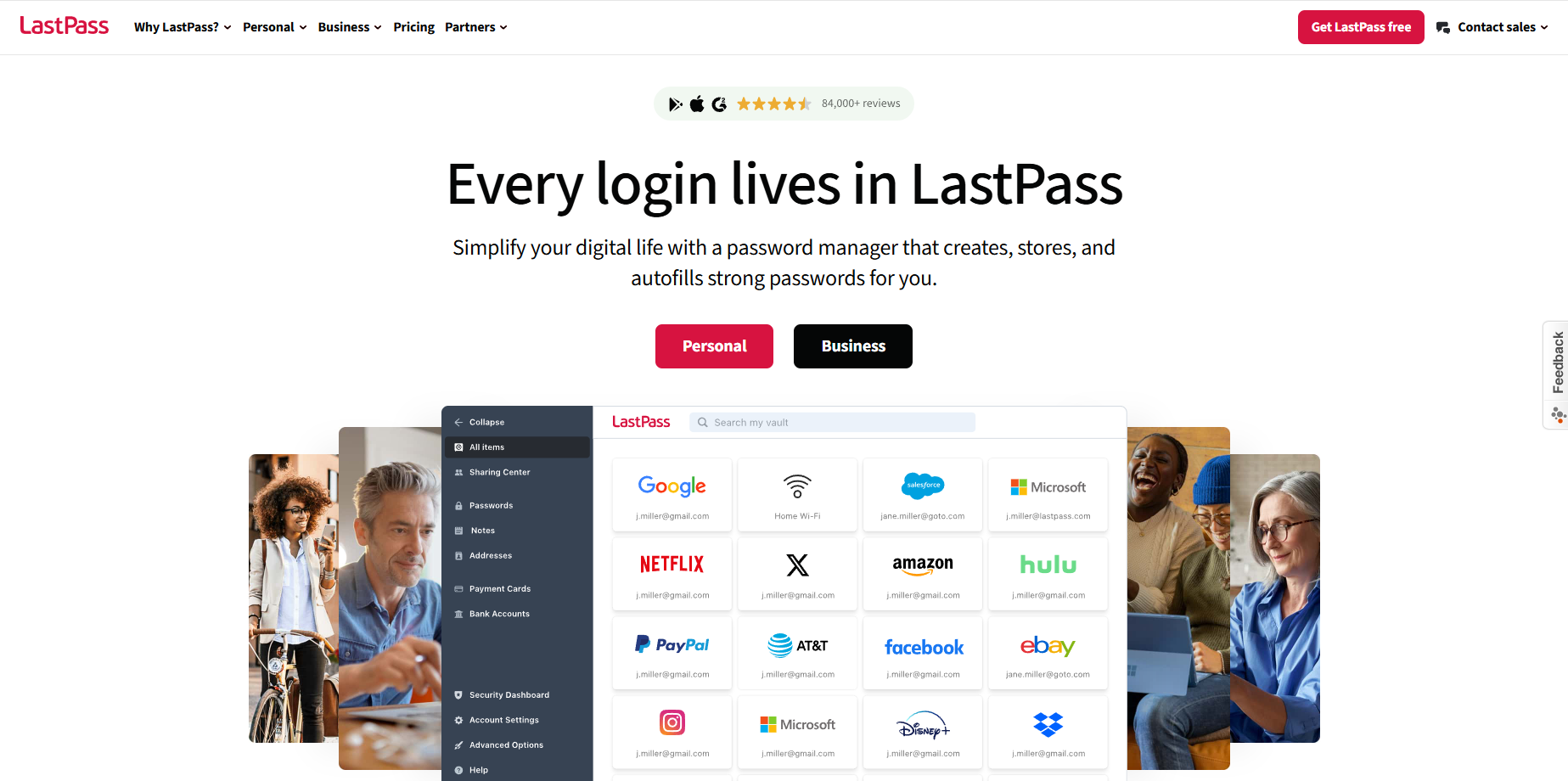

What LastPass Gets Right

Let's start with what matters. LastPass checks the boxes that actually move the needle for the mass market:

- Easy access from anywhere

- Affordable plans (at least on first glance)

- Secure password vault with all-in-one storage for passwords, cards, notes, and addresses

- Solid website and messaging discipline compared to many competitors

- Onboarding that's been battle-tested: extension → first password → autofill

If someone is new to password managers, LastPass still delivers that crucial first impression: "Yep, this solves it."

The product experience is strong. The onboarding is straightforward. The core value becomes obvious within minutes. The marketing foundation is solid, with clear promises around security, strong passwords, and universal access. Multiple buying paths exist, from self-serve to talking to sales.

For first-time password manager buyers, LastPass genuinely feels secure, affordable, simple, and complete. That's a real advantage.

And that's exactly the problem.

The Real Bottleneck: Positioning + Packaging

The constraint isn't onboarding anymore. It's not features. It's not even awareness.

The bottleneck is positioning and packaging. Specifically, the current plan architecture creates confusion. And in security products, confusion doesn't just kill conversion (it kills trust). And trust isn't a "nice to have" in this category. Trust is the product.

Here's what surfaces immediately when you walk through the buying journey:

The "Teams" Plan Creates More Questions Than Answers

Is Teams a real team plan? What's the per-user pricing? When you compare it to competitors like 1Password's Team Starter Pack ($15/month for up to 20 users), the math gets confusing fast. If LastPass Teams is $10/month for teams, is that $2 per user? That would make it twice as expensive as 1Password.

But here's the bigger issue: Teams doesn't even appear as an upgrade option inside the product. When you sign up for Business and look to upgrade, you only see Business and Business Max. Teams simply disappears from the journey.

The Free Model Has Lost Its Competitive Edge

We need to talk about what's changed in the market.

When LastPass first launched, having a password manager at all was revolutionary. The free plan was compelling because the alternative was sticky notes and memory.

Today? The real competitor for "free" is the browser itself. Chrome's password manager. Edge's password manager. Apple's Keychain. These have gotten extremely good for personal use. They sync across devices. They autofill. They generate strong passwords. And for most people, they trust Google or Apple as much as (or more than) they trust LastPass.

Your free plan (limited to one device, basic password management) doesn't do anything meaningfully better than what ships with every browser. The free moat has eroded. Your competitors have surpassed you.

The "Why LastPass" Messaging Reads Like Checkboxes

Look at the reasons on the website: "Easy access from anywhere. Affordable plans. A secure password vault. An all-in-one solution."

These aren't differentiators. They're table stakes. Every password manager can claim these things.

And here's what's interesting: LastPass is actually one of the easiest platforms to use. That's a real advantage. But "we're easier" doesn't hold weight when everyone says it. There's no defensible wedge here. No clear reason someone would choose LastPass over 1Password beyond "it checks the boxes."

The Business vs. Teams Pricing Doesn't Pass the Five-Second Test

Business is $7/user/month. Teams appears to be $10/month total. Business Max is $9/user/month.

What's the actual difference? According to the website:

- Business includes "LastPass Families for employees"

- Business has "group user management"

- Business Max adds "100,000+ security policies"

But this raises more questions than it answers. If I'm paying for Business, does that mean I'm also paying for my employees' families? What happens when someone leaves the company? Do their family members get punted to the free plan?

And if Teams has an "admin console," why doesn't it have "group user management"? Is Teams just an underpowered Business plan?

For a product where trust is everything, this level of confusion is expensive.

The Ceiling This Creates

This system reliably wins checkbox buyers. Up to a point.

Beyond that point, growth flattens because:

- People don't upgrade when they're unsure what plan actually fits their needs

- Teams (startups, small businesses) default to clearer, more obvious options

- "We're easier" doesn't hold weight as a durable competitive moat

- Free users don't perceive enough of a "must-have" delta compared to their browser

- The pricing architecture creates distrust before trust

The result? More effort for less growth. Returns flatten. You're working harder to move the same needle.

The Missed Opportunity

Here's the good news: LastPass doesn't need more features.

It needs three things:

1. A sharper "Why LastPass" (not checkboxes, but a defensible wedge that creates real preference).

What makes LastPass the obvious choice? Not just a good choice. The obvious choice. Right now, the answer is "it's easy and it checks the boxes." That's not enough when browsers are free and 1Password is clearer.

One bold example: What if you made the entire personal plan completely free? Not limited to one device. Not crippled. Actually free. You'd become the password manager everyone uses personally, and you'd monetize exclusively on the business side. Disruptive? Yes. Expensive? Maybe. But it would answer "Why LastPass?" in a way that actually matters.

2. Simpler packaging that matches how people actually buy

Less is more. Five plans is too many when two of them (Teams and Business) seem nearly identical and one of them (Teams) disappears during the actual signup flow.

Either make Teams unmistakably clear as a startup/small team option with transparent per-user pricing, or eliminate it entirely. Having a plan that's 25 cents per user cheaper than Business doesn't scream "we're making a lot more money here." It screams confusion.

3. A free model decision

Either make the free plan truly, meaningfully better than Chrome, Edge, and Safari's built-in password managers... or kill it.

The middle ground (one device, basic features, 30-day trial of premium) isn't compelling. People aren't signing up with the intention to stay. They're not telling their friends. They're not expanding to work usage.

If the free plan isn't driving growth, it's just training people to expect less from you.

Why This Matters

This is the type of constraint that teams usually want validated internally before acting. It's not obvious from the metrics dashboard. It doesn't show up as a bug report. It lives in the gap between "people understand what we do" and "people choose us over the alternatives."

It's the space between awareness and preference.

And it's solvable. Not with more features. Not with a redesign. But with clearer positioning, simpler packaging, and a willingness to make the hard calls about what you're really competing on.

When you sign up for LastPass Business today, the onboarding is smooth. The extension installs cleanly. You add your first password. It autofills. The core product works.

That's not the problem.

The problem is that before someone even gets to that onboarding, they've already hit friction:

- "Is Teams right for me or is that too limited?"

- "Why would I use this over my browser?"

- "What's actually different between these plans?"

- "Does Business mean I have to pay for families?"

By the time they reach the product, they're already uncertain. And uncertainty kills conversion in security products faster than anywhere else.

The Path Forward

The opportunity here isn't incremental. It's strategic.

LastPass has brand awareness. It has a product that works. It has distribution. What it needs is clarity.

Clarity on who it's for. Clarity on why it's different. Clarity on how to buy it.

That clarity doesn't come from adding more features or running more onboarding experiments. It comes from answering one question with absolute conviction:

What makes LastPass the obvious choice in the market?

Right now, the answer is "it's good enough and it checks the boxes."

That's not a strategy. That's survival.

The next unlock isn't in the product. It's in how you frame it. It's in making the hard calls about what plans to kill, what the free tier should actually do, and what story you're telling that makes someone stop comparing spreadsheets and just choose you.

Because when the basics are working (and they are), the constraint isn't execution.

It's positioning.

Ready to Fix Your Own Positioning Problem?

👉 Jump into a Free Growth Session and get hands-on guidance

👉 Check out the ProductLed PLG System for a clear, step-by-step plan to grow faster

👉 Become a Top PLG Operator with the ProductLed MBA™ as a practical blueprint for mastering product-led growth

👉 Get the ProductLed Playbook (Free) to master the fundamentals of PLG

👉 Sign up for our Newsletter for weekly tips and ideas to scale smarter