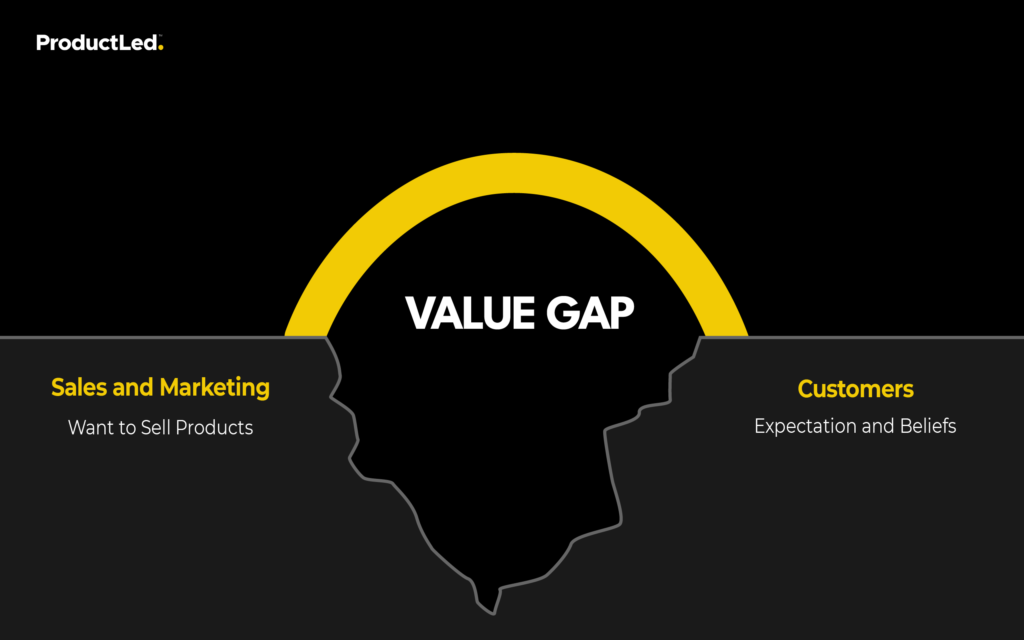

The value gap is a common problem many companies face in their SaaS go-to-market strategy. This "gap" occurs when there is a disconnect between the value the company believes their product provides and the value the customer perceives.

If not addressed, this gap can lead to low adoption rates, customer churn, and, ultimately, a loss of revenue.

Unfortunately, 95% of companies (SaaS and otherwise) have value gap problems and don't even know it.

That's why learning how to prevent and treat them is essential.

By the end of this article, you'll gain an understanding of the value gap concept, its implications for B2B SaaS companies, and practical steps to identify and address this issue in their go-to-market strategies.

What is the Value Gap?

A value gap is a discrepancy between the perceived value of a product or service and the actual value. It's when users have certain expectations and experience another.

While the value gap isn't a highly complex problem, companies don't often recognize it.

Symptoms of a Value Gap Problem

The road to identifying a company's value gap problem starts with pinpointing the symptoms.

Common symptoms are:

- Campaigns are not performing or underperforming

- Low conversion rates

- High churn rate

- Problems growing user base

Other symptoms are more conflicting, such as:

- Low conversion and high churn with a well-performing campaign

- An underperforming campaign with good conversion and a low churn rate

The value gap expresses itself in different ways.

You can have both a value gap and a good product fit for a segment of the market. At times, there can even be an antithesis in what's happening between the acquisition.

Most companies' most significant challenge is identifying the problem early enough to avoid burning cash on treating the symptom rather than the solution. We first need to identify the problem to come up with the answer.

The Value Gap Canvas™ Framework

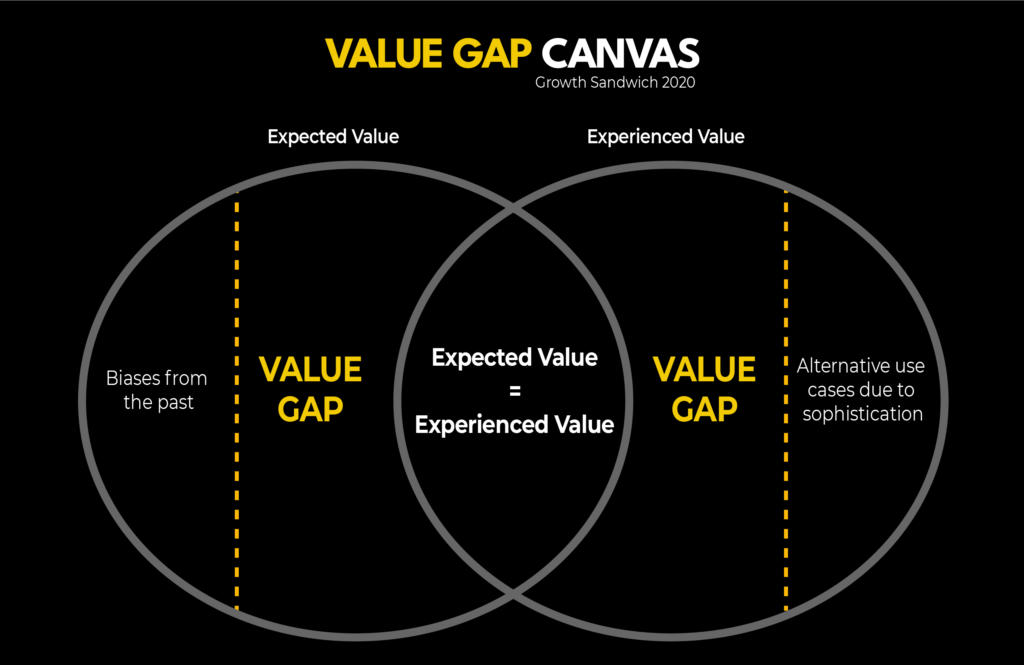

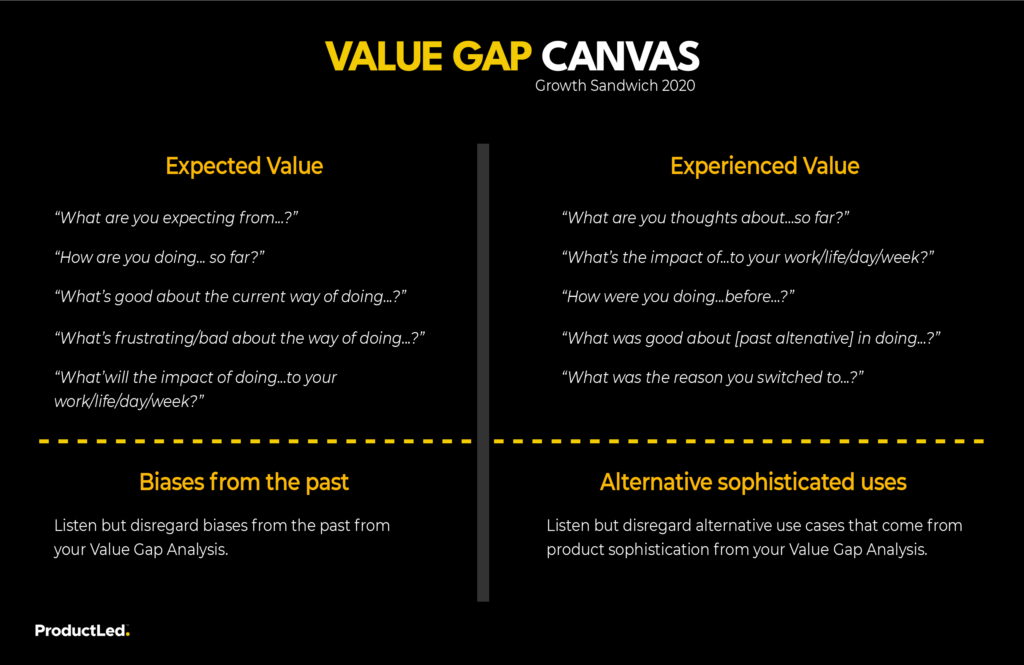

The Value Gap Canvas™ is a visual representation to help SaaS businesses identify and address the value gap within their product or service.

The framework below represents overlapping a product's expected value with the experienced value.

Let's look closer at the Value Gap Canvas, beginning with an examination of the types of value.

Expected Value vs. Experienced Value

The value gap is created when the user's expectations don't match the user's experience.

Here's a brief explanation of how this is showcased on the Value Gap Canvas:

- Expected Value: The left circle represents what the user expects to receive from your product or service. Their preconceived assumptions and expectations about your offering can be better, worse, or different.

- Experienced Value: The right circle represents the actual value that your product delivers to the user, considering their real-world experiences and interactions with your offering.

How to Identify Your Value Gap [in 2 steps]

Your company suffers a value gap when expected and experienced values don't overlap. This two-step approach will help you identify the problem.

Step 1: Step Back and Ask Questions

Try thinking on a broader, more generalized macro level of your current strategy with the following phases of questions.

Begin by asking yourself:

- How is my positioning?

- Does my positioning give the wrong expectations to my users?

- Is my copy clear?

If positioning is misaligned or the copy is unclear, users may expect one thing and experience another. Look at your content copy and positioning to see if you have strong-performing campaigns but low conversion rates.

Then ask:

- Am I underestimating my product?

- Am I underselling my product?

Underselling a product is the most common with startups.

This problem is most common with startups. When a company doesn't realize how good their products actually are compared to their competitors, or when you have a happy client base but trouble growing that base, you may not be clearly communicating how good your product is.

Next:

- Does my product deliver as advertised?

- Am I overselling my product?

If you don't have a clear picture of your current competitive landscape, your product may not be as great as you think. If your company needs more conversion rates and churn, it could be time to take a deeper look at how well your product performs and if it's meeting customers' expectations.

And finally:

- Is my product now being used for something other than initially intended?

- Should you reposition your product to adopt a new segment?

The market is constantly evolving, and your core customer base may have started using your product for something other than its original intended use. This point is the time to explore if a product's true value in the market differs from how it's currently positioned.

If your company needs help growing its customer base, new users could need clarification about the intended use of your product.

Step 2: Fresh Users Vs. Power Users Analysis

To further understand your problem, breaking down the experience differences between Fresh and Power Users is essential.

The value gap will differ for each user segment based on their perspective of the product experience. By identifying the expectation differentiations between Fresh and Power Users, you can identify problems and solve them.

What is a Fresh User?

A Fresh User has no experience with the product or has experienced it for a short time – under 10 minutes.

What is a Power User?

A Power User is a user who has adopted and retained a product.

The exact way a Power User uses your product will vary. For instance, some companies will have Power Users that adopt different uses for a product. Others may have extreme brand loyalty, use your products for their needs, and then use online platforms to comment about your products and connect with other users.

Product Experience

Whether it's a Fresh User or a Power User, each will have its own perspective on a product's experience.

For example, let's look at Slack. If Slack deviated from its original purpose of connecting teams to being used for communities, can we expect a Fresh User to build a community?

Probably not.

They most likely joined for an accessible, straightforward, simple communication tool between teammates, an expectation that Slack can deliver.

If a Fresh User expected something completely different from Slack, or if Slack confused Fresh Users into expecting a different value proposition, it would create churn and low conversion.

How to Close the Value Gap

Fixing the value gap is a matter of comparing data and evidence.

A powerful and easy way to collect data is by asking questions whenever a potential customer or customer comes in contact with your brand–before, during, or after purchasing something from you.

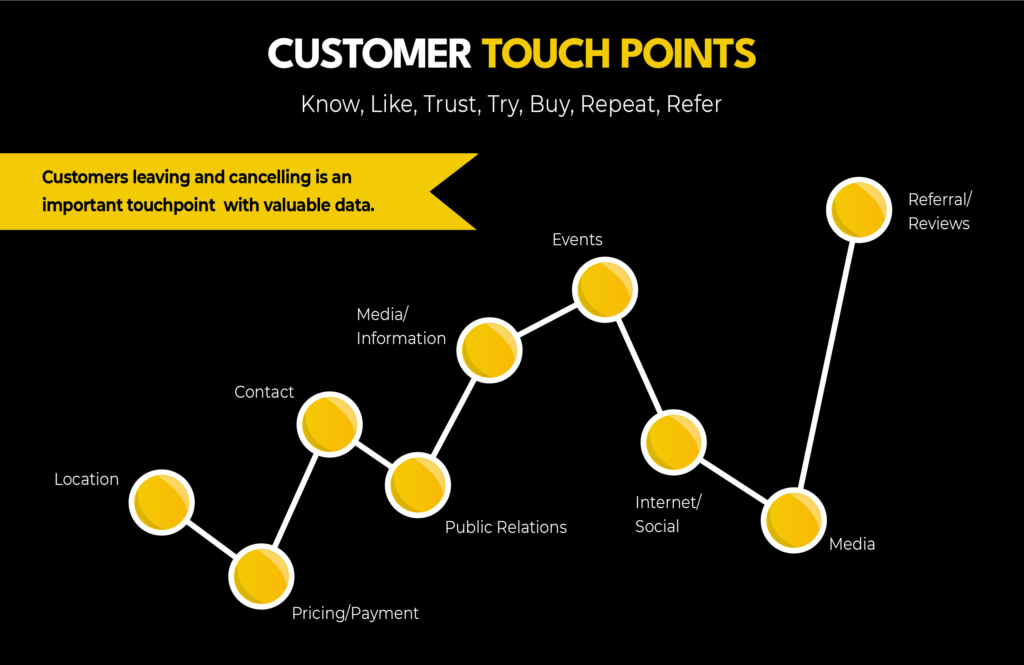

Customer Touchpoint

Each contact is called a customer touchpoint.

Touchpoints help identify problems and allow you to research your users' experiences.

For example, the primary customer touchpoints are:

- Website: a user visiting your site for the first time.

- Product: a user learning about your product and understanding its function.

- Purchase: seeing the value proposition and buying the product.

- Customer Service: billing or support to optimize a product's use for a user's problem.

- Marketing/Media Information: any relevant news, promotions, etc.

- Events: to help bring more value to the user with your product.

- Social Media: to allow a user to evaluate companies.

- Referrals/Reviews: customer feedback on strengths and weaknesses of the product.

- Cancellation/Leaving: understanding where the product or service failed.

Once you've collected the data, you can fix the value gap by comparing the feedback between Power Users and Fresh Users. Doing so will clarify the value proposition each user segment needs to perceive to be happy with your product.

For example, if you speak with 20 Power Users and they expect oranges, and you speak with 20 Fresh Users, and they expect lamb, that's a big problem.

By user research and gathering evidence through interviews, qualification questions, or cancellation of service questionnaires, you will better understand the expectations and experiences of users.

The evidence through data will help build a strategy to bridge your gap.

What to Do if Your Product Differences Are Subtle

Most industries have products that are less distinct than lambs and oranges. In reality, the differences are usually subtle, and explaining why your product is different can be unclear.

If your value proposition isn't a priority for users, consider the following:

- You may be failing to explain what differentiates your product from competitors.

- You may be targeting the wrong demographic.

- Your product may not be as good as you think.

It's essential to understand the unique way your product helps a user that other products do not.

While evaluating user feedback, remember you can't follow the critiques of every single user. Look for common complaints or suggestions to help improve the user experience.

Research to Prevent or Fix a Value Gap

About 95% of businesses with poor acquisition rates or high customer churn have a value gap problem. Companies that avoid the value gap problem tend to lean on quality research.

But how do you know if you are conducting quality research?

Every research tactic has its time, place, and role. Ideally, you don't want to stick to just one. It shouldn't be all surveys, all interviews, or all data analysis. It should be both qualitative and quantitative.

A business should first focus and consider what they don't know. As soon as a company can identify what's missing, it can focus on strategy.

Before outsourcing research, take advantage of all digital and physical touchpoints. Learning from these touchpoints will save both money and energy. For example, the research will help inform whether you should do demos, constellation interviews, or take the time to speak directly to customers.

With digital touchpoints, you can set up a buyer qualification page that the user fills out at purchase. The qualification page should ask basic questions such as:

- How do you identify?

- How do you expect our product to help you?

- What is your role in the business?

The idea is to understand the user better so you can anticipate their expectations while they use your product.

When a client cancels your product, this presents an opportunity for a completely different data set. You can ask another round of questions, such as:

- Why did you decide to leave?

- How could our product meet your needs better?

- How can we improve our service?

Using digital touchpoints to gather data as users come and go will provide a clearer picture of the user's journey.

A better idea of a user's journey can help businesses notice gaps, correct them, and better align themselves with the expectations of future users. It can also provide a starting point for outsourced research teams.

Conduct User Interviews

A great way to get quality research is to perform interviews.

Here are some questions to start with:

For expected value:

- "What are you expecting from...?"

- "How are you doing...so far?"

- "What's good about the current way of doing...?"

- "What's frustrating/bad about the way of doing...?"

- "What will the impact of doing......to your work/life/day/week?"

For experienced value:

- "What are your thoughts about...so far?"

- "What's the impact of... on your work/life/day/week?"

- "How were you doing...before...?"

- "What was good about [past alternative] in doing...?"

- "What was the reason you switched to...?"

Feedback Analysis

Analyzing feedback through interviews is one of the most potent ways to extrapolate critical information.

While reading through them, do the following:

- Underline the most significant observations

- Underline the assumptions

- Cluster the insights under big categories

- Filter out biases from the best of the Fresh Users

- Filter out alternative use cases your Power Users have developed

- Figure out the discrepancies between what Fresh Users said compared to what Power Users said

As you review your research, go-to-market strategies and ways to bridge the value gap should start to emerge.

SaaS Go-To-Market Strategy and The Value Gap

SaaS is one of the most effective strategies on the market today; however, it's not a silver bullet and puts a lot of pressure on your product.

Many SaaS companies with value gap problems have products that need hand-holding. SaaS products should be strong enough to stand independently without user intervention.

Before becoming product-led, ensure you've slain basic, scalable tactics such as positioning and user experience.

When you are product-led, data and qualitative evidence become paramount. For success, double down on evidence and research.

SaaS customer support directly feeds into customer success because businesses need product-sophisticated customer support teams that understand the user's needs.

By becoming more curious about your users, your business can benefit a lot.

Overall, conduct a thorough value gap analysis for any SaaS go-to-market strategy.

Before throwing more money at underperforming campaigns, step back and see if your business is displaying any symptoms and then work from there to resolve them.

To continue building a successful product-led business, build out the nine components of the ProductLed Method, including a five-step process, so that you can provide enormous value to your users.

For deeper training on product-led growth strategies, check out the ProductLed MBA, The Product-Led Playbook, or work with a ProductLed Implementer for hands-on support.