Combine analytics with SaaS product development, and you'll build a better product.

In this article, I'll share how to use data to help craft your SaaS product strategy. I use the word "help" because we are not yet to a point where data can tell us exactly what to do. The world of B2B SaaS is very complex.

What we're doing today is at the intersection of art and science, and combining them means you can build a truly compelling product experience.

It's important to think about the art and science of product development, especially in B2B SaaS. Let's look at an example.

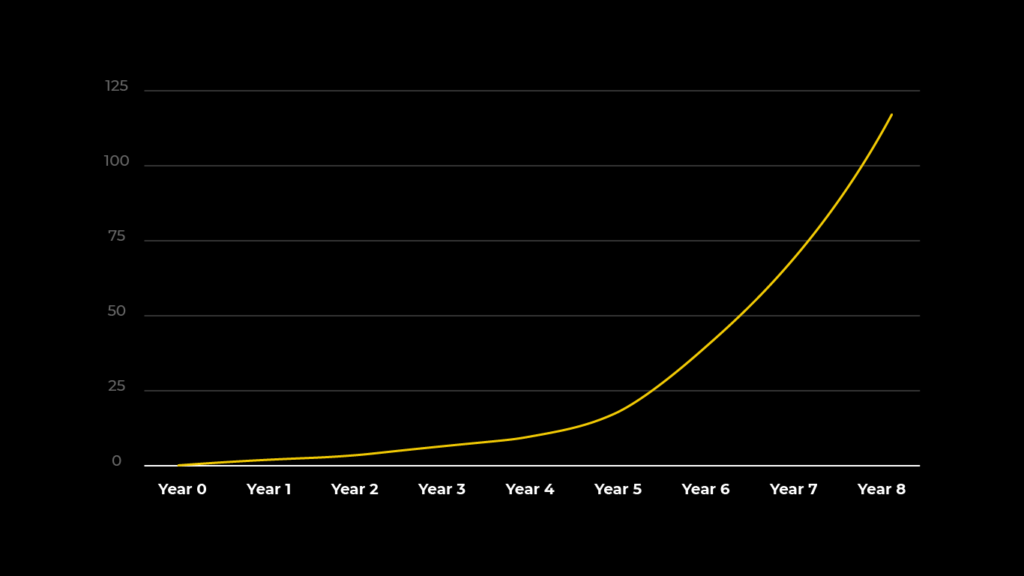

Do you know what the growth curve below represents?

It's the growth of the internet!

The graph shows that it took eight years to achieve 100 million users, and it was one of the fastest adoptions of technology at the time.

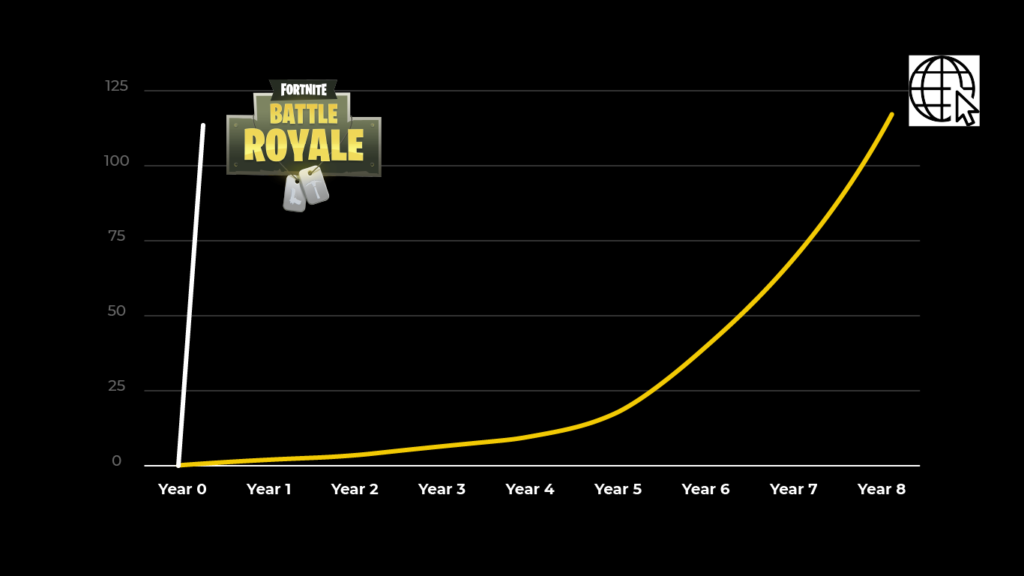

What do you think this growth curve might be?

This chart shows that Fortnight Battle Royale took just three months on iOS to achieve 100 million users. During this period, the online video game grossed nearly one billion dollars.

These examples of growth speak to how quickly unique product experiences can transform industries.

So what is a SaaS Product Strategy and what are its benefits?

A product strategy is a high-level plan for your business that touches on product development, growth, and business. It's used to identify a product's benefits, who it's meant for, and how it differentiates itself from competing products already at market.

There are many benefits to creating a product strategy, including:

- It ensures your product is user-focused.

- It aligns your team on the vision of the product.

- It provides you with an action plan.

Where Product-Led Growth Fits Into a Product Strategy

Product-led growth (PLG) is a sector that shows potential for companies to build transformative and innovative product experiences their customers love. It's a business model where the product does all the talking: users try it out for free, get value, and decide to upgrade to a paid plan.

A recent Forrester report found that 75% of B2B clients prefer buying products through a website or app versus a salesperson. So how exactly are companies achieving industry success? And what practices can you apply into your product roadmap and SaaS product strategy to build these customer experiences?

I can tell you what they're not doing.

They're not going through business school marketing exercises, gathering their board for an annual strategy meeting, or hiring marketing strategy consultants.

Instead, these companies are using product-led growth to develop winning viable products. The experiences they're building and delivering through their product are their competitive advantage. If you want to learn whether product-led growth is the right strategy for your business, check out this article here.

Three Steps to Building a SaaS Product Strategy

Nearly 85 percent of SaaS product managers agree that setting up a product strategy is key to product success. But what steps can you take to accomplish this company goal?

Successful product-led companies have product strategies with three key elements:

- Set a vision and create clarity through a clear and measurable North Star.

- Develop a strategy that integrates behavioral science into their decision-making frameworks.

- Become accountable for results-oriented outcomes.

Let's look at how a few B2B SaaS companies are doing each of these.

Step 1: Set a vision and create clarity through a clear and measurable North Star

A successful Saas product strategy starts with a clear vision. There are many definitions of what "vision" is and how to approach setting a vision for your company, but I like to define vision as the measurable world we want to create. After setting your product vision, the North Star metric is your product’s key measure of success and represents the value you’re delivering to your customers.

Defining Your Vision

A great product-led company sets a vision to create clarity around what matters most.

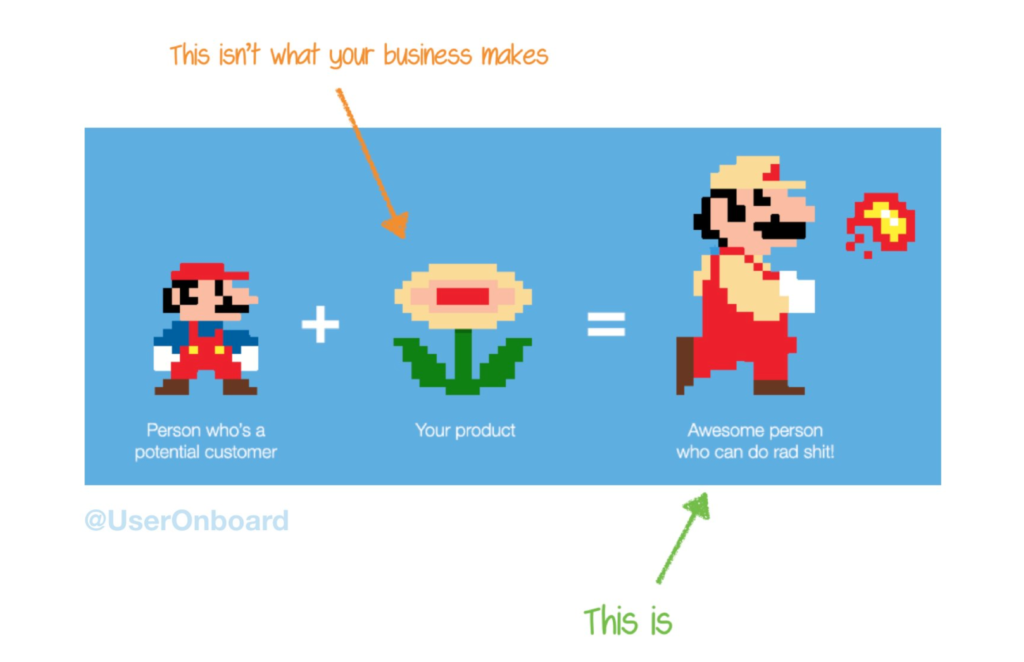

Nintendo’s Fire Mario is relevant to product management trying to develop a vision. Fire Mario is the form Mario takes after powering up with a Fire Flower, and he’s an excellent analogy for marketing strategy.

The User Onboard Group created this graphic to explain. Small Mario represents the customer, and where they are today. The fire flower represents your product. Fire Mario represents how awesome Mario can become if he has access to our product.

The graphic below is by User Onboard and shows that:

- Small Mario represents the potential customer, and where they are today.

- The Fire Flower represents our viable product.

- Fire Mario represents how awesome Mario becomes when he accesses your product.

When most people think about product vision, they think about the Fire Flower in the middle. But actually, the product vision is about Small Mario and the pain he's in. Fire Mario becomes Fire Mario when he discovers his newfound abilities gained from using your product.

As a product manager, it’s essential to focus on customer pain and the outcomes your company wants to drive.

The Great Product Vision Example of Spotify

Spotify's vision is simple but powerful – give people access to all the music they want all the time in a legal and accessible way.

If we break this vision down, we start to see a lot of Small Mario and Fire Mario.

Product VariablesSmall MarioFire MarioWhat music can be played?Purchased musicAll the musicWhen can the music be played?When the radio plays the musicAll the timeHow can the music be accessed?Illegal torrents and downloadsLegal accessWhere can the music be played?Need a compatible deviceAccessible

Nowhere in its vision statement does Spotify mention product features. The focus is on curating the ultimate outcomes they want their customers to experience.

Analytics is an important part of product vision. To scale a company, you need to know where you're going. Without a compelling vision, strategy, and data, all other aspects of a company don’t matter.

Finding Your North Star

A North Star is like the guiding light that moves your company from the vision to the impact you want to create.

Set a compelling North Star that drives your product strategy by:

- First, define the game you're playing.

- Then, identify a North Star that drives business outcomes.

- Finally, choose input metrics that are leading indicators of that North Star.

To set your North Star, you must first pinpoint what game you’re playing. If you think you are playing checkers, but all of your competitors think you're playing chess, you will have a tough time winning.

In SaaS, there are three different games.

- The Game of Attention: The attention game focuses on delivering value through the amount of time the user spends on your product. Typical North Stars for the game of attention include the total time spent engaging with content, streaming hours, etc.

Examples: Facebook and Netflix are in the game of attention because they want users to spend as much time as possible on their sites. - The Game of Transaction: The transaction game is when the purpose of your product is to have users engage in a transaction. A few typical North Star metrics for transaction-based SaaS companies include the number of purchases completed, upgrades purchased, and searches completed.

Examples: Amazon, United, and Walmart are examples of companies playing the transaction game. - The Game of Productivity: The productivity game involves getting users to some sort of task success. Typical product North Stars for this game includes the number of records created, messages sent, and queries completed.

Examples: Classic examples are Slack and other B2B SaaS companies like Amplitude, Asana, and Salesforce.

How to Set a North Star for Your B2B SaaS Company

The strategic focus is to determine the best North Star for the game you are playing.

To create an effective North Star for your company, you must design it around your company goals within your game. Even within the same game, not all North Stars are the same.

Your North Star must:

- Measure Customer Value: Stats like opening the app or clicking an ad might be important for your marketing strategy, but they don’t add value for the customer.

- Align With Product Vision: What is your Fire Mario? Ensure that whatever variable takes users from Small Mario to Fire Mario is what you use to measure product success.

- Have a Leading Indicator of Revenue: The North Star metric should not be revenue because it's a lagging indicator. Instead, use a product outcome that leads to revenue to align your marketing and SaaS product management teams.

A word of warning when setting your North Star – do not make your North Star a vanity metric. Typically, vanity metrics are "top of the funnel" metrics. It may be important to measure the number of active users, but a good North Star metric is deeper into the funnel.

Postmate's North Star metric is something they call "Happy Deliveries," which is an on-time delivery with no errors. If they can achieve a "Happy Delivery" to the customer, they are more likely to come back, increasing retention and customer lifetime value.

Let's go back to the example of Spotify and see if we can build up what their North Star metric might be.

We'll start by asking a straightforward question: What does the CEO of Spotify care about?

The answer to that is simple: revenue. But our North Star shouldn't be revenue but a revenue driver.

So, how does revenue translate into a North Star for a product like Spotify?

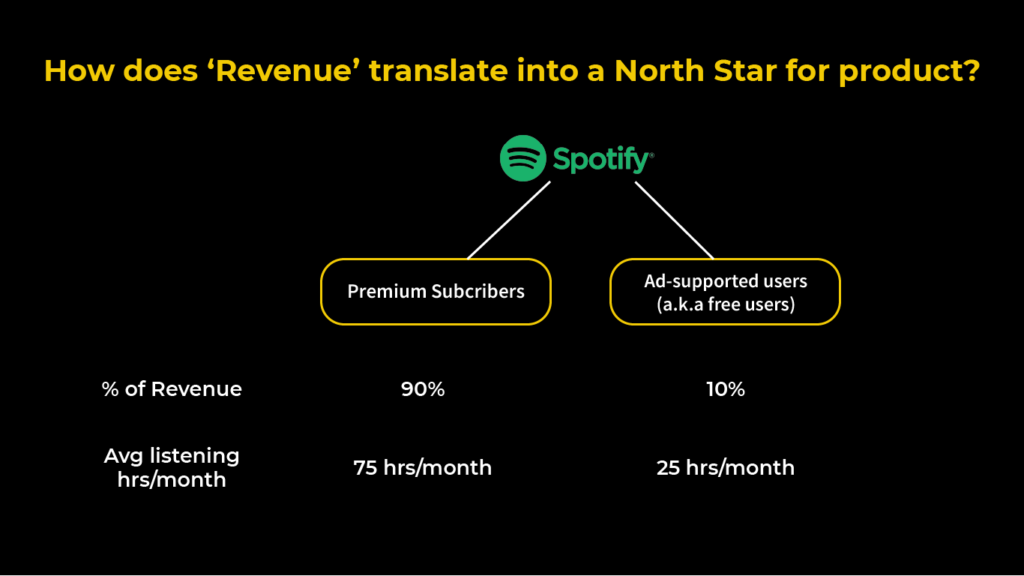

To answer that question, we must identify how Spotify generates revenue. The company has two primary sources of revenue. One is through ad-supported users, and the other is through premium subscribers.

Which one do you think is larger? Do you think Spotify has more premium subscribers driving revenue or more revenue from ad-supported users?

About 90% of Spotify's revenue is from premium subscribers, while 10% of its revenue is generated from free users. Not only that, but premium subscribers tend to listen to music on Spotify longer than free users. Data shows that the average listening hours per month for premium subscribers is around 75 hours versus 25 hours for ad-supported users.

Given this information, we can guess that Spotify's North Star metric considers:

- The number of premium subscribers because it drives revenue.

- The length of time listening to music because they're in the game of attention.

When we asked Spotify, they said their North Star is time spent by subscribers listening to music.

Is this a good North Star? It measures customer value, aligns with the company's product vision, and is a leading indicator of revenue.

It's a great North Star for Spotify.

Step 2: Develop a strategy that integrates behavioral science into their decision-making frameworks.

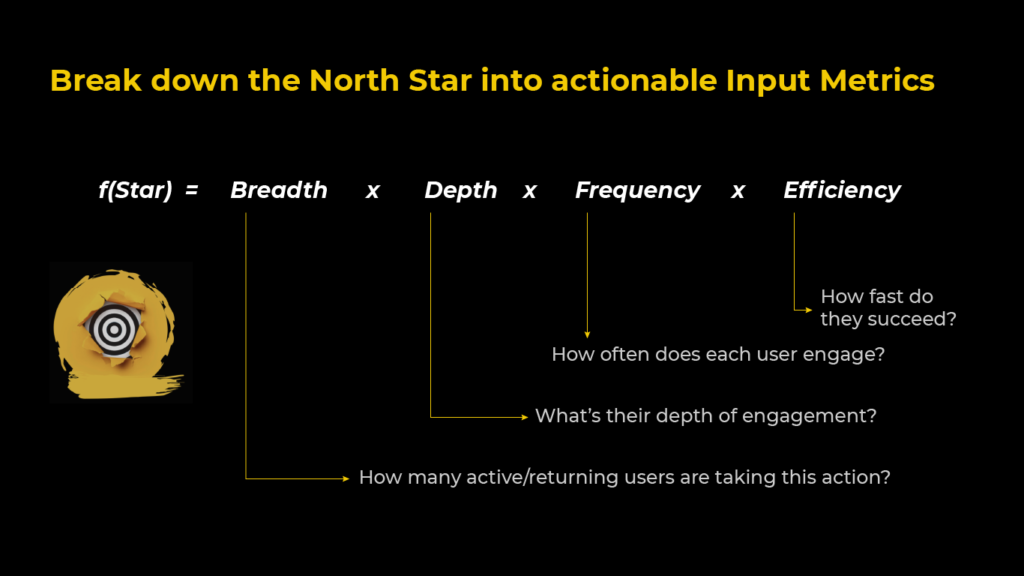

The next step is setting a strategy to make sure you’re moving towards the North Star and delivering on the product vision. Start by breaking down the North Star into actionable input metrics.

Every North Star can be broken down into four metrics:

- Breadth: How many active/returning users are taking this action?

- Depth: What's their depth of engagement?

- Frequency: How often does each user engage?

- Efficiency: How fast do they succeed?

Every North Star is some combination of three or four of these different drivers.

Spotify’s Product Strategy

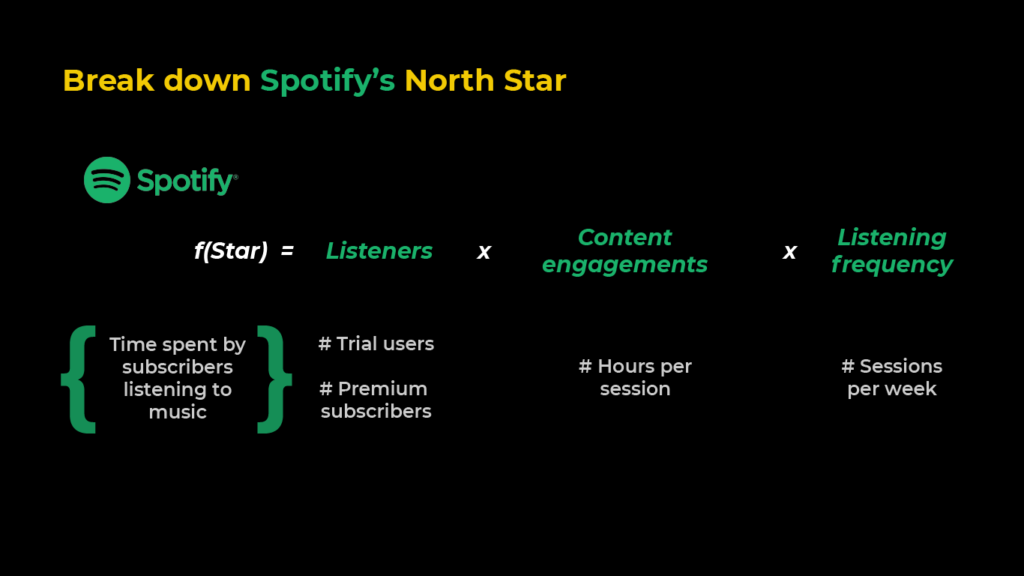

Let’s break down the driving metrics of Spotify’s North Star.

As outlined in the graphic, the North Star of Spotify includes:

- Breadth (Active listeners, trial users, and premium subscribers)

- Depth (Content engagement, the number of hours per session)

- Frequency (Listening frequency, the number of sessions per week)

If we create a strategy around driving these input metrics, the North Star metric of Spotify should improve over time.

Netflix’s Product Strategy

Netflix's staggering growth is an interesting example of behavioral science in action.

When Netflix was still in the business of delivering DVDs in the early 2000s, it wasn't clear if the company would be successful. They used the North Star framework to create a compelling user experience for their customers.

The first question to ask is what game is Netflix playing? The company is in the game of attention.

The next question is, what is Netflix's North Star? According to Netflix's Head of Product, it was the number of subscribers. But they didn't stop there. Instead, they thought about the biggest drivers of the North Star.

Monthly retention was one of the biggest drivers, and they had 92% retention with only 8% churning every quarter. Netflix knew they had to reduce that churn to increase their existing customer base.

They broke it down further and found that the number of DVDs in your queue had a significant impact on whether you would retain or churn at the end of the month. Over 60% of their customers had only three DVDs in their queue.

Netflix crafted its strategy around increasing the number of customers with at least three DVDs in the queue. In the next 18 months, they increased that figure from 60% to 90%, and monthly retention moved from 92% to 98%. That's a four-time reduction in overall churn.

A 2022 Product Strategy Update for Netflix

In 2022, Netflix experienced a reduction in subscribers for the first time in a decade. The Guardian reports that the share price of Netflix dropped after it announced a net loss of 200,000 subscribers and expects to lose a further two million over the next three months.

Increased pricing for monthly subscriptions and account password sharing are factors that may be playing a part in the drop in Netflix subscribers. But unlike when Netflix first got started, the company has more streaming services competitors, including Apple, Hulu, Amazon, Disney, and HBO.

Netflix has been successful because of its ability to create a compelling user experience that drives the growth of its North Star metric. However, Netflix is now grabbling with how to maintain its competitive advantage. The company is still in the game of attention and needs to brainstorm new ways to either attract new users or reduce the churn of loyal monthly subscribers.

The extensive library of series, documentaries, and movies that Netflix has built up doesn’t seem enough to wow its consumers anymore. Should Netflix focus more on making original content? In 2018, there were rumors the company planned to launch a free gaming service for subscribers. Only time will tell what strategic decisions the company makes to improve its customer experience.

How Behavioral Science Impacts Your B2B SaaS Product Strategy

Behavioral science is about identifying the critical outcome you are trying to drive. However, this outcome is actually a lagging indicator, which means it takes a long time to see improvement.

Instead, you need to look at the leading indicator of the outcome and define the input metrics that drive the leading indicator. It will help you set a strategy and align your team around the critical input metrics and create a sales, content, marketing strategy, and product strategy, etc.

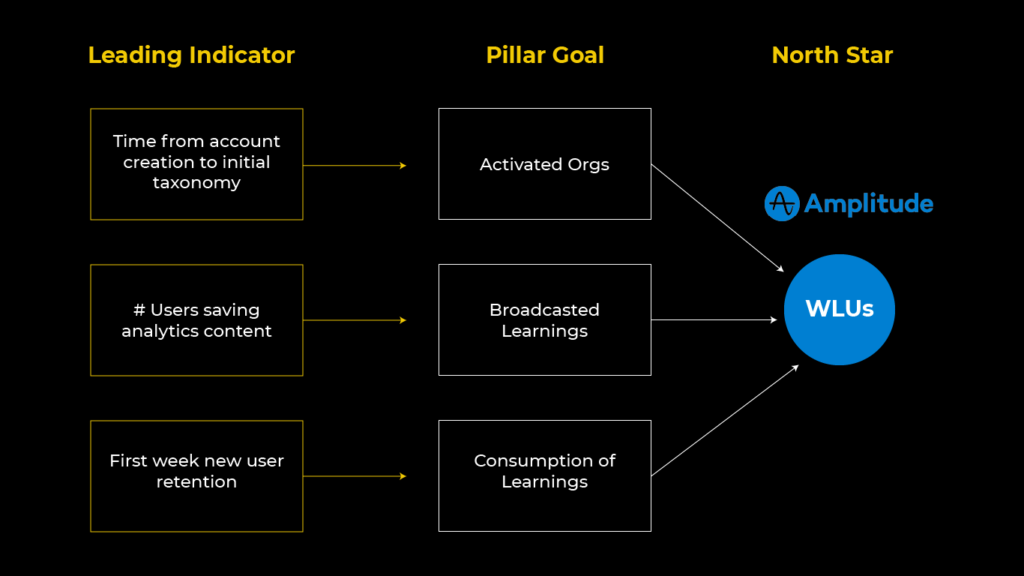

At Amplitude, our North Star is weekly learning users (WLU), the number of users who get insight and then share that with two or more people at their company. We break that down into key drivers, and we have pillar goals organized around those.

Our pillar goals are activating organizations, broadcasting learning, and learning consumption. We need to make it easy for each of these three variables to happen.

These pillars identify the leading metrics they drive. For activating an org, we need to know how long it takes for an organization to get its data into Amplitude. If they don't have data, they can't activate, and then we can't grow the number of users.

Over time WLU will increase if these metrics grow. This point leads us to the final piece, measuring results.

Step 3: Become accountable for results-oriented outcomes.

The growth of a product-led company must be results-driven. Results show if you are on the right path using an objective measure.

Objectives and Key Results (OKRs) are among the most common ways for a SaaS business to measure results. In the B2B SaaS world, I've seen OKRs implemented by dozens of companies, and some commonalities aren't helping facilitate product-led growth.

Use OKRs When Measuring Results

Objectives, then key results – not the other way around. Vision and strategy are the essential variables to set first. Metrics help you measure if you're on the right path, so always start with the objectives first.

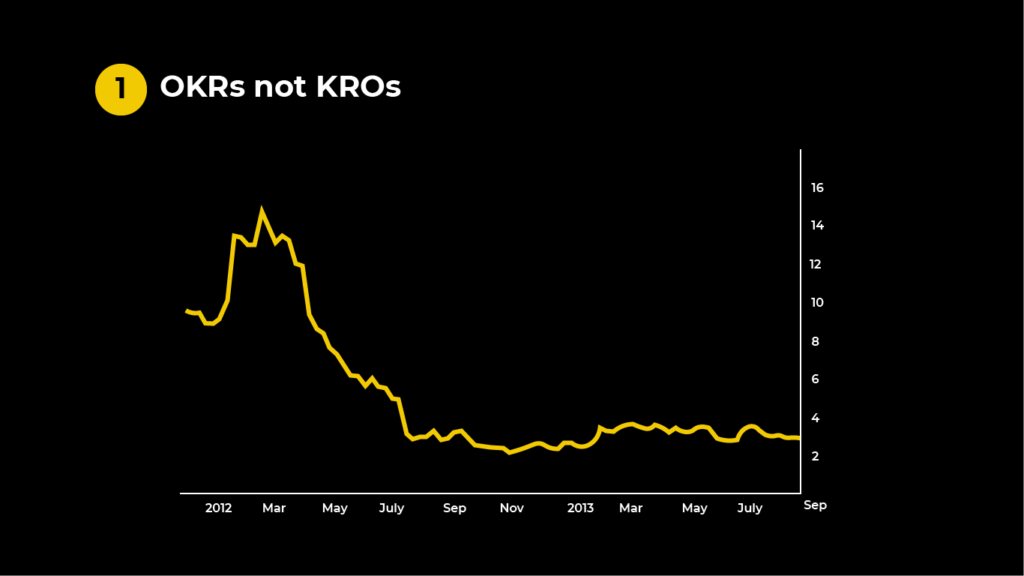

The stock ticker in the graphic above is for the gaming company Zynga from 2012 to 2013. You could argue that Zynga invented product analytics, but unfortunately, the company lost sight of the vision – of their Fire Mario – and optimized for metrics. This scenario may generate short-term outcomes but won't create a compelling customer experience needed to develop a successful SaaS software development process.

When Should You Measure Your OKRs?

Most companies measure their OKRs every quarter. However, it doesn't make sense for every company to evaluate their product experiments in the same cadence.

A quarter feels like a long time. It's 90 days, but when you take out weekends, holidays, evaluation time, and lost time from other projects, you're left with about a month to set and measure the OKR before the end of the quarter.

This leads to a repeating pattern of rushed experiments, missed OKRs, and endless frustration.

Instead, ditch the quarter. Think about the long-term outcome you want to drive and how long it would take to get a massive improvement in your North Star. Give your team time to think big about how they can get those results.

How to Create a Learning Cadence For Your Team

Next, what is your learning cadence? How often will you shift to ensure you're on the right path? A startup might change every week and set the input metric for a week. If you're not hitting that metric after a week, go back to the drawing board and try again.

At Amplitude, we recommend a learning cadence of at least two weeks, but let your team set their own. Some more significant projects may need a longer learning cadence.

How to Benchmark for The Game You're Playing

Always have your North Star metric in mind and benchmark your goals for the game you are playing, whether it's the game of attention, transaction, or productivity.

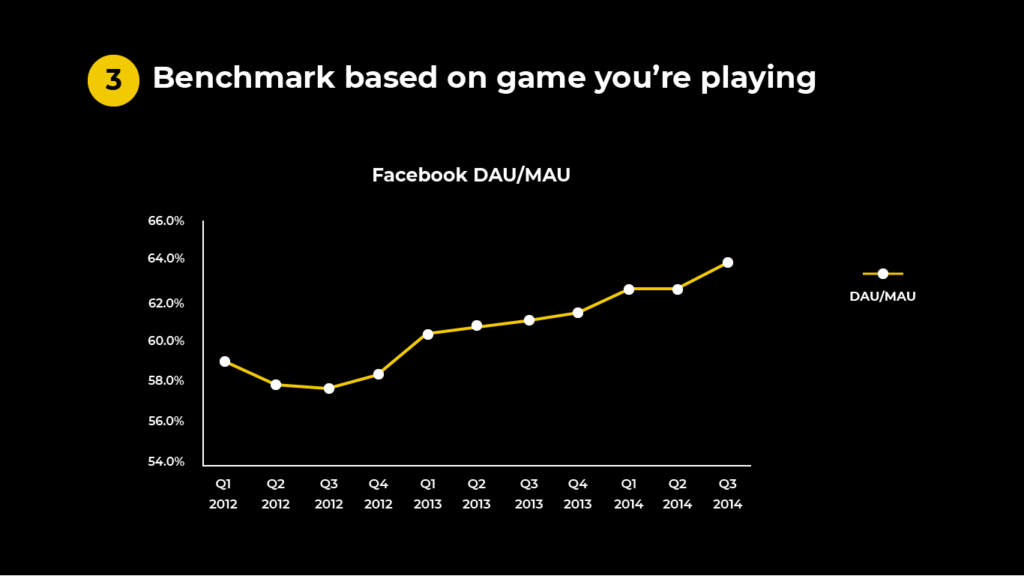

Facebook is a great example.

Facebook's key metric was a frequency metric, DAU/MAU, the percentage of monthly active users using the product every day. Facebook hovered around 60%, a very impressive measure, and venture capitalists used DAU/MAU as the metric that determined whether they would fund ventures.

It doesn't make sense to use DAU/MAU for most businesses or even as a good reflection of frequency. DAU/MAU is great for an attention-based product. However, in the productivity space, with a B2B SaaS like Amplitude, I don't want users logged in 30 days out of the month because that means they're not being effective with their time and getting the benefit of our product.

Looking at the game of conversion, if I told you a company had a DAU/MAU ratio of 30% you might not think that was very good - it's only half of what Facebook had. But for a company like Amazon, where on their mobile product, 30% of the people who visit monthly shop daily, that is an incredible metric for the game of conversion.

Finally, Document Your Strategy in a Product Charter

The Product Charter is a simple document that helps people better understand your vision, strategy, and results.

Begin your Product Charter by clarifying your product vision:

- Vision statement

- Your ideal customer (whose behavior will change because of this work?)

- Problem (what is their current problem?)

- Outcome (what the customer can accomplish)

- Risk (why you believe you can solve this problem)

- North Star Metric (what is the long-term impact of solving this problem?)

Next, take people through your product strategy, which involves:

- Strategy (How will you achieve the goal?)

- Risky Assumptions (What assumptions do you need to validate?)

- Non-scope (What are your non-goals?)

- Timeframe (Time to see the long-term impact.)

- Learning Cadence (How long to get to first learning?)

- Customer Partners/Internal Stakeholders (Who has reviewed this charter?)

Finally, you can use your charter to provide an overview of the results:

- Context (current state of the world, as related to problem area)

- Problem (the specific area this effort is focused on addressing)

- Objective (What success looks like at the end of this effort)

- Scope (Who will be working on this? How long for?)

- Measure of Success

Join ProductLed Academy to scale your product-led business, faster

Creating your SaaS product strategy is just one key element of building a successful product-led business. At ProductLed Academy, we help SaaS founders turn their products into predictable revenue-generating machines. It's a 12-month program, where we focus on one of the nine components you need to master (we spend around six weeks on each of these):

- Vision: What is your company really good at?

- User: Who do you serve best?

- Model: How do you create a ton of value for your users to win?

- Offer: Have you crafted an irresistible free offer for your ideal users?

- Experience: Have you created an effortless path to value for your users?

- Pricing: Is it easy for users to upgrade without talking to anyone?

- Data: Do you know where users are getting stuck in your product?

- Process: Do you have a growth process that enables your team to build out experiments, prioritize the high-impact ones, and launch the ones that are easiest?

- Team: Is your team full of A players capable of taking you to the next level?

While you can have one or more of these dialed in perfectly, if you’re missing one of these key players, you’re going to have a hard time with growth.

Apart from focusing on those key areas of your strategy, ProductLed Academy comes with:

- Weekly 60-minute group coaching call with Wes Bush, where you'll go through each of the components of the ProductLed Method (including pricing) to master a self-serve model.

- Weekly non-negotiable tasks to keep you accountable.

- Access to an exclusive ProductLed Founder Community so you can meet other ambitious founders and receive support 24/7.

- Access to the ProductLed Vault, where you'll gain access to all of our programs (including ProductLed Acquisition and Accelerator), templates, and frameworks.

If you're ready to break through to the next level and scale your product strategy, be sure to check out ProductLed Academy.