Annual contract value (or ACV) refers to the total value of a customer's contract with a business over one year. It's an essential metric for businesses, especially SaaS and product-led growth companies, as it provides insights into the revenue generated from customer contracts on an annual basis.

ACV helps businesses understand the average value of their contracts and can be used to analyze customer trends, forecast future revenue, and measure the success of sales and marketing efforts.

This article will break down calculating ACV, explain why annual contract value is essential, and differentiate the metric from annual recurring revenue (ARR) and total contract value (TCV).

How to Calculate Annual Contract Value

Calculating annual contract value is a simple step-by-step process.

First, you must gather data on the total value of all customer contracts signed within a year. This process includes both new contracts and renewals.

Next, add up the total value of these contracts.

Finally, divide the total value by the number of customers to get the average ACV.

Why Is Calculating ACV Important?

Calculating the ACV is an essential step in understanding the financial health of your business and making strategic decisions to drive growth. It clearly defines your revenue potential and allows you to track and analyze your sales performance over time.

Calculating the annual contract value is vital for several reasons:

- The metric helps you understand the total value of your contracts over a year, providing a clear picture of your revenue potential.

- It allows you to track the growth or decline of your business by comparing the ACV from different periods.

- ACV helps you make informed decisions about pricing, product offerings, and customer acquisition strategies.

So, calculate and monitor your annual contract value regularly to stay on top of your business's finances.

ACV vs. Total Contract Value (TCV)

ACV and TCV are key metrics used in the subscription-based business model for many SaaS companies. ACV refers to the average annual revenue generated from a customer's subscription, while TCV represents the total revenue expected to be generated over the entire contract duration.

Calculate ACV by dividing the total contract value by the contract duration. It provides a snapshot of the revenue generated on an annual basis and helps businesses understand the average value of their customer base.

Differently, TCV considers the contract's entire duration and provides a more comprehensive view of the revenue potential. It includes any one-time fees, add-ons, or upgrades that may be included in the contract.

Comparing ACV and TCV

ACV and TCV track the amount earned per user over different periods.

ACV focuses on the annual revenue generated by a customer's contract, whereas TCV considers the total value of the contract over its entire duration. This means that ACV provides a snapshot of the revenue generated in a given year, while TCV offers a more comprehensive view of the contract's value.

Both metrics also vary in terms of usage.

Businesses often use ACV to measure the annual revenue generated by their customer contracts and forecast future revenue.

On the other hand, TCV is used to assess a contract's overall value and calculate metrics such as customer lifetime value.

ACV vs. Annual Recurring Revenue (ARR)

ACV and ARR are metrics used to measure SaaS companies' financial health and growth.

Understanding the differences between ACV and ARR is crucial for accurately assessing a company's performance and making informed business decisions.

ACV, or annual contract value, refers to the total value of a customer's contract over 12 months. It takes into account any discounts or additional fees associated with the contract. ACV is often used to determine the revenue generated from new customers or the value of a customer's contract when it is renewed.

On the other hand, ARR, or annual recurring revenue, measures the predictable and recurring revenue generated by a company's subscription-based business model. It represents the yearly revenue a company can expect from its customers continuously. ARR is calculated by taking the total value of all active subscriptions and dividing it by the number of months in the subscription period.

Comparing ACV and ARR

One advantage of using ACV as a metric is that it provides a more comprehensive view of the value of a contract. By factoring in any discounts or add-ons, ACV gives a clearer picture of the revenue generated over a year. This can be particularly useful for businesses with different pricing models or complex contracts.

On the other hand, tracking the ARR metric can be more straightforward. By focusing solely on the recurring revenue generated from a contract, ARR provides a clear indication of the ongoing revenue stream for a business. This can be helpful for companies that have a large number of subscription-based customers or have a high level of customer retention.

Scroll down for a helpful side-by-side comparison of these SaaS metrics and total contract value in the section below.

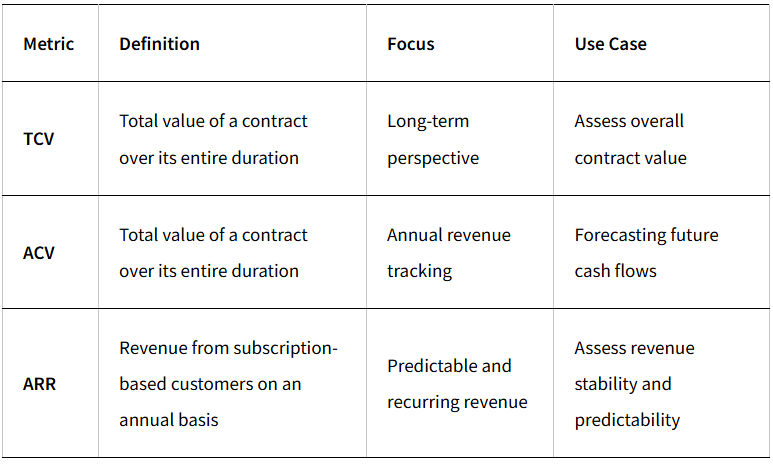

TCV vs. ACV vs. ARR

Total contract value (TCV), annual contract value (ACV), and annual recurring revenue (ARR) are all metrics used by SaaS companies for measuring revenue and contract value.

Here's a chart to help you decipher each metric's different focus and user case.

ACV vs. Customer Lifetime Value (LTV)

ACV and LTV provide valuable insights into a customer's value but differ in their focus and time frame.

Metric Focus

ACV focuses on a customer's annual revenue, providing a snapshot of their value within a given year.

LTV, on the other hand, considers the entire customer relationship, providing a more long-term perspective on their value.

Time Frame

ACV is beneficial for businesses that operate on a subscription or contract basis, as it allows them to track and analyze the revenue generated by each customer annually.

Alternatively, LTV is more commonly used in industries where customers make repeat purchases over time, such as retail or e-commerce.

Choosing the Right Metric

In this article, we have compared ACV with several additional SaaS metrics. The following outlines when using ACV, TCV, ARR, and CLV is beneficial in specific scenarios:

- If you want to measure the value of currently active contracts and generate revenue, then annual contract value (ACV) is the appropriate choice.

- If your focus is on the total value of all contracts signed within a specific period, then total customer value (TCV) is your metric.

- If you want to track the recurring revenue generated by your contracts annually, then annual recurring revenue (ARR) is the metric that will provide the most relevant information.

- If you want to understand the long-term value of your user, then customer lifetime value (CLV) is an excellent metric to track.

For even more metrics and PLG term knowledge, head to our "A-to-Z Glossary: Essential Product-Led Business Growth Terms."

Recap on Annual Contract Value

Understanding ACV is crucial for making informed business decisions. It clearly defines the value of contracts over a year and helps calculate revenue projections.

By differentiating annual contract value ACV from other metrics like ARR, TCV, and LTV, businesses can comprehensively understand their financial performance and make strategic decisions accordingly.

Choosing the right metric that aligns with your business goals and objectives is necessary to maximize the growth and profitability of your SaaS business. Companies can effectively measure and optimize their sales strategies, customer acquisition, and revenue generation by accurately calculating ACV and using it as a key performance indicator.

Continue to expand your product-led knowledge and drive the growth of your SaaS company by leveraging the valuable insights from Wes Bush's bestselling book, “Product-Led Growth: How to Build a Product That Sells Itself.”

Alternatively, if you’d like to work with a coach to implement these components into your business, check out ProductLed Academy.

It’s our intensive coaching program where we’ll help you build a strong foundation for product-led growth so that you can scale faster and with more control.

What’s unique about this program is we’ll work with you and your team to implement the proven ProductLed Method so that you can scale faster with less stress.

We’ll go through everything we went through today with your team to ensure everyone is working on building out solutions that will have an outsized impact.