Customer acquisition cost (or CAC) is a metric that gauges the average money a company spends to acquire a new customer. Simply put, it measures how much it costs to bring in each new customer.

Why CAC Is an Important SaaS Metric

Understanding and optimizing your CAC is the key to unlocking sustainable and profitable growth for product-led growth (PLG) companies.

Applying the CAC metric, product-led businesses can evaluate the effectiveness of their customer acquisition efforts and determine the return on investment (ROI) for each customer. Through the comparison of CAC with the customer lifetime value (CLV), an accurate measure of profitability from customer acquisition emerges.

Moreover, a thorough understanding of CAC is important for guiding data-driven decisions. This metric equips SaaS founders with the means to allocate resources efficiently, pinpoint issues within onboarding, and fine-tune customer acquisition strategies.

Determining Your Customer Acquisition Cost

To calculate CAC, you need to calculate the total expenditure incurred in the process of acquiring new customers. This includes expenses related to advertising, marketing campaigns, sales efforts, and any other costs associated with acquiring new customers.

CAC Formula

To calculate customer acquisition cost, PLG companies can use the formula:

CAC = Total Cost of Expenses / Number of New Acquired Customers

Customer Acquisition Cost in Product-Led Growth

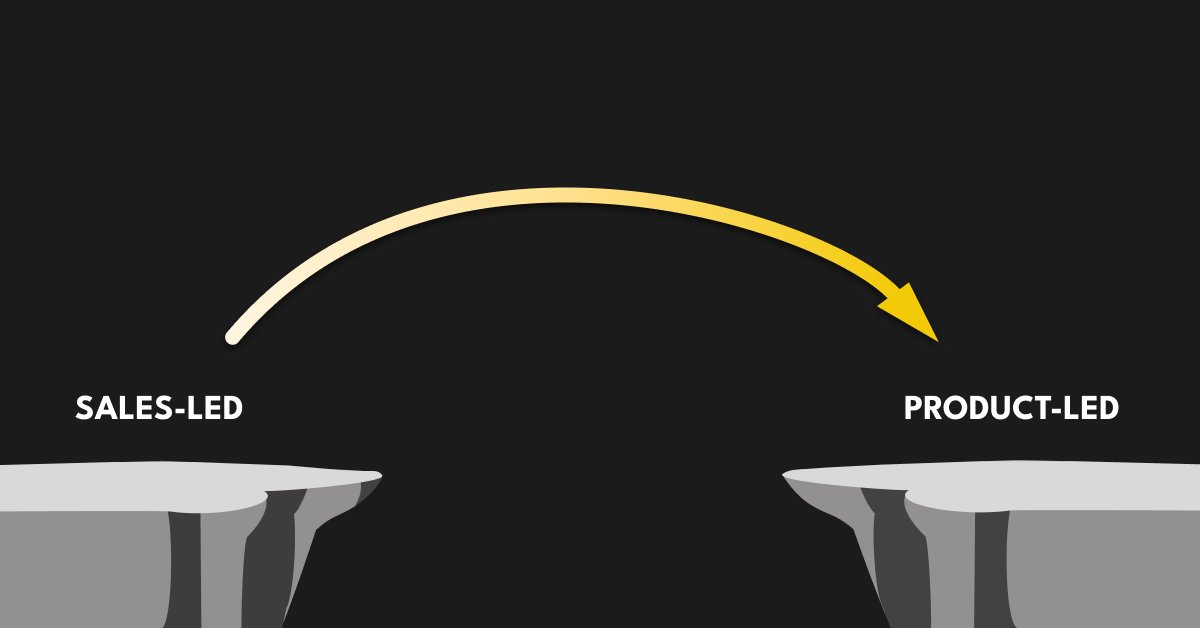

CAC tends to be lower for product-led companies and higher for sales-led companies due to differences in their respective business models and customer acquisition strategies.

The lower customer acquisition cost for product-led companies is often a result of their focus on a self-serve model, virality, free or freemium products, and automation, which reduce the need for expensive sales efforts. Conversely, sales-led companies prioritize high-touch sales interactions, which can be effective but come at a higher cost, leading to a higher CAC.

Let’s delve further into how a product-led approach contributes to lower CAC.

Self-Serve Model

SaaS self-serve models, allowing users to sign up and explore the software’s value independently, typically operate without the need for sales team support. This approach minimizes the labor-intensive, high-touch sales efforts, ultimately resulting in a decrease in CAC.

Reduced Reliance on Paid Acquisition Channels

A virally-driven freemium product can serve as an organic user acquisition tool and potentially reduce or supplement your reliance on paid acquisition efforts. Instead of investing heavily in purchasing top positions on search engines or social networks, you can capitalize on the product's virality and word-of-mouth marketing.

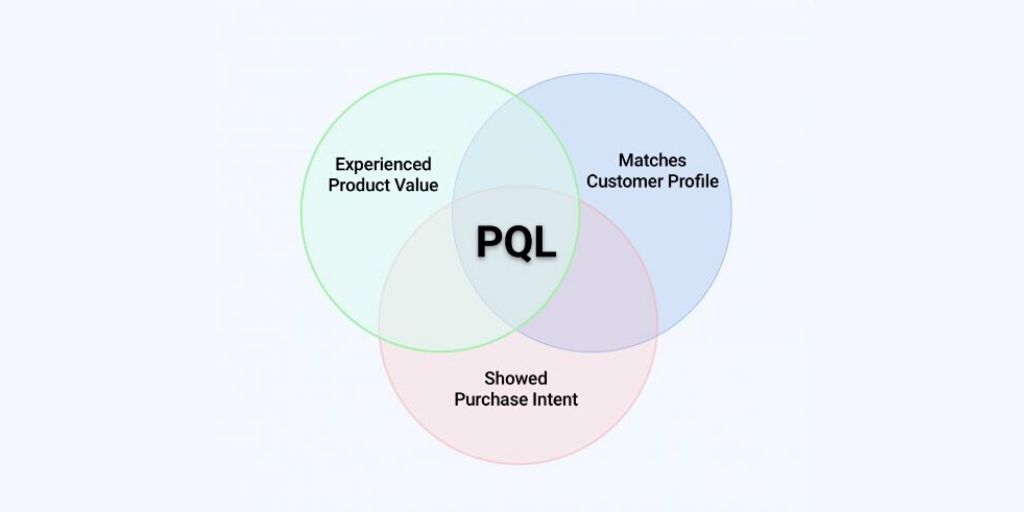

Targeting High-Value Prospects

Companies with a product-led sales approach can focus the effort of their sales team on prospects with greater value potential. This, in turn, empowers the product to autonomously serve the small and medium-sized business market.

When customers upgrade to a paid plan without needing to talk with a sales representative, the customer acquisition costs are reduced compared to scenarios where the same customer requires the time and attention of a sales rep.

How Customer Lifetime Value Affects Customer Acquisition Cost

In product-led companies, where the product is a key factor in acquiring and retaining users, the relationship between customer lifetime value (CLV) and CAC has a significant impact on various business elements, influencing acquisition strategies, product development, and overall business sustainability.

Let’s explore the connection and influence of these two metrics within PLG and discover how CLV and CAC can be instrumental in paving the way toward sustained growth and profitability.

Assessing the Efficiency of Your User Acquisition Efforts

When CLV is significantly higher than CAC, it indicates that the value a customer brings over their lifetime is greater than the cost incurred to acquire them, which is a positive sign for profitability.

Better Resource Allocation

When CLV exceeds CAC, it often makes sense for a product-led company to invest more in customer acquisition because each customer brought in is expected to yield a positive return over their lifetime.

Optimizing Growth

PLG companies aim to increase CLV while minimizing CAC to achieve sustainable growth.

When to Iterate

PLG companies often use CLV and CAC as key performance indicators (KPIs) to continually refine their strategies.

By optimizing these metrics, companies can refine their targeting, user onboarding, and product features to enhance the overall customer experience and financial performance.

Inform SaaS Product Development

Products that attract new customers and retain and upsell existing ones tend to have a more favorable CLV-to-CAC ratio.

How to Lower CAC

Lowering CAC is a priority for product-led companies, as it directly impacts profitability and growth.

One way to reduce CAC is by focusing on improving customer retention and increasing CLV.

By providing exceptional customer experiences, delivering product value, and implementing effective customer success strategies, companies can retain customers for longer periods, thus reducing the need for constant acquisition efforts.

Additionally, optimizing marketing and sales processes can help lower CAC. This includes targeting the right audience through precise segmentation, leveraging data-driven marketing strategies, and implementing efficient lead nurturing and conversion tactics.

Companies can acquire customers more cost-effectively by focusing on quality leads and improving conversion rates.

Recap of Customer Acquisition Cost

Customer acquisition cost is a crucial SaaS metric for product-led companies. It plays a pivotal role in assessing and optimizing customer acquisition efforts, ROI evaluation, and data-driven decision-making.

By understanding CAC and its relationship with customer lifetime value, PLG companies can pave the way for sustainable growth and profitability. These metrics inform effective resource allocation, user acquisition strategies, and product development, ultimately enhancing the customer experience and financial performance.

To learn more about how to become a data-led organization, be sure to check out this article. This comprehensive guide walks you through the ProductLed Data Process, which shares the metrics you need to track for your product-led business.