If you're running a B2B SaaS company, you've likely felt the pressure. Your board is asking about PLG. Your investors are pointing to Slack, Figma, and Zoom as examples of "how growth should work." Your sales team is overwhelmed with low-value prospects while your best enterprise opportunities wait in the pipeline.

The question isn't whether you should consider Product-Led Growth, it's how to implement it without destroying what's already working.

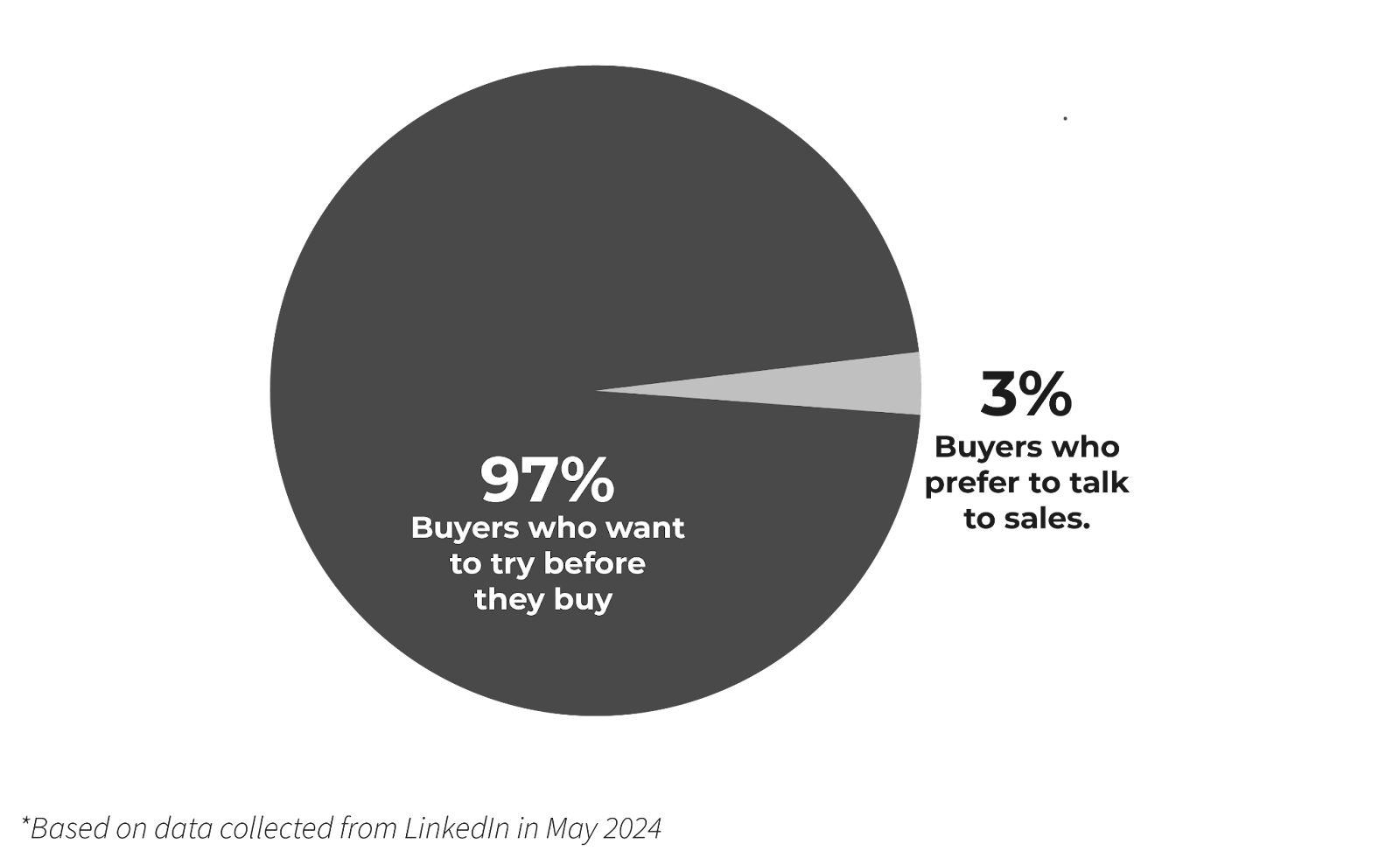

Only 3% of buyers preferred speaking to sales, while a whopping 97% wanted to try before buying. This is a seismic shift, not a trend.2

This guide provides a comprehensive framework for transitioning from a sales-led to a product-led approach without jeopardizing your existing revenue streams while building a compelling Product-Led Growth (PLG) business case that secures CFO approval, protects current revenue streams, and unlocks the multi-million-dollar opportunity hidden within your product.

Watch the full video here. | Spotify | Apple Podcasts

Part 1: Why PLG Now? Essential Mindset Shifts

It's Not "Product-Led vs. Sales-Led" - It's "How Product-Led Should You Be?"

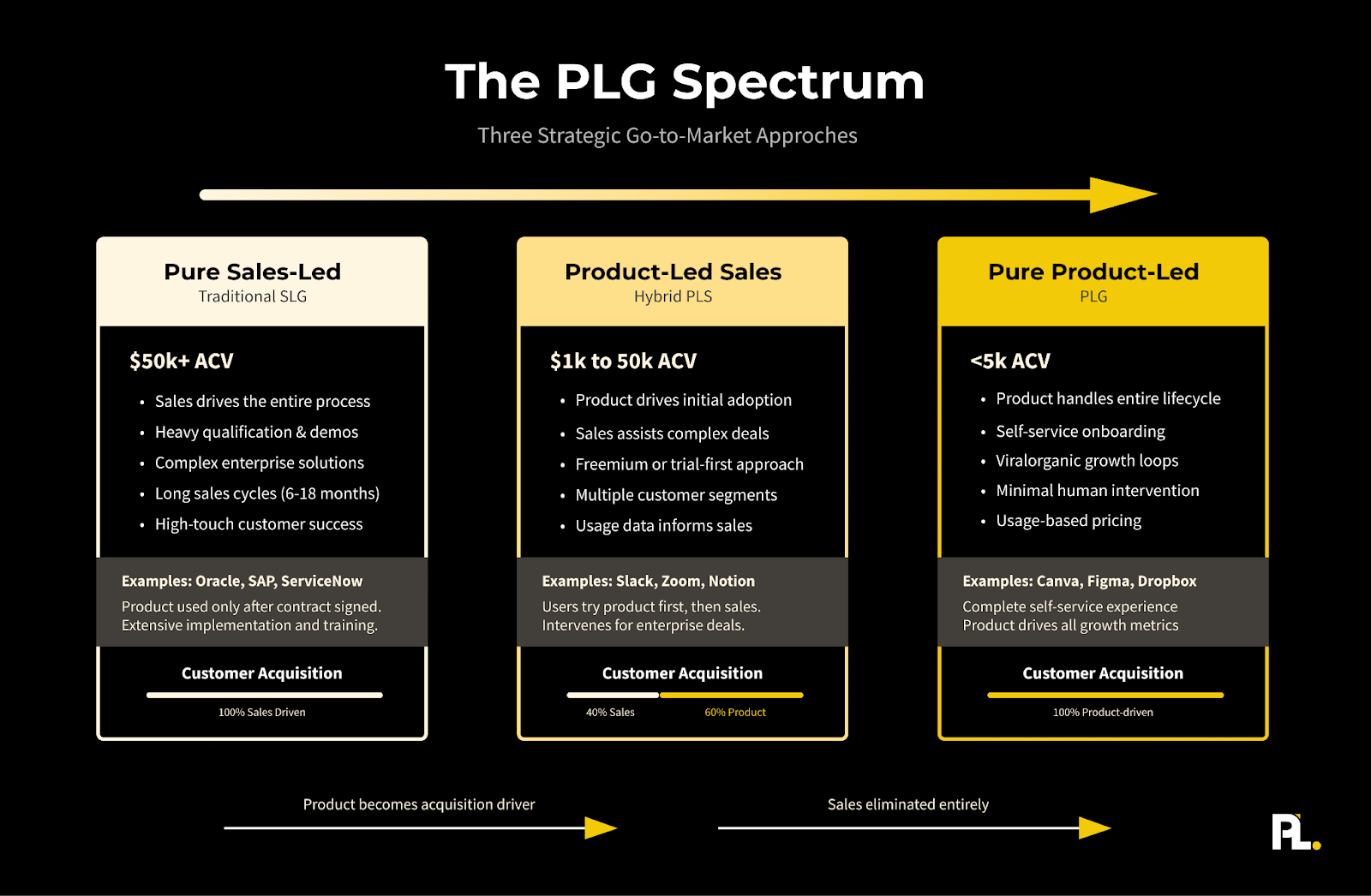

The most dangerous misconception about PLG is treating it as an either/or decision. Product-Led Growth exists on a spectrum, and the most successful companies find their optimal position based on product complexity, deal size, and customer segments.

The PLG Spectrum: Three Strategic Positions

1. Sales-Led Growth (SLG)

- Best for: Complex enterprise solutions with $50K+ ACV

- Approach: Sales-led for enterprise deals

- Example: SAP solves very complex problems

2. Hybrid Product-Led Sales (PLS)

- Best for: Products serving multiple segments from $1K-50K+ ACV

- Approach: Pure PLG for SMB, sales-assisted for mid-market, and sales-led for enterprise

- Example: Zoom's freemium consumer with enterprise sales motion

3. Pure Product-Led Growth (PLG)

- Best for: Simple products with <$5K ACV

- Approach: Product handles entire customer lifecycle

- Example: Canva's self-serve design platform

Key Insight: According to the ProductLed Benchmark Report, companies with self-serve revenue consistently outperform their counterparts across virtually every metric, with the most dramatic performance improvements happening during the initial transition from zero to even modest self-serve revenue ($100K-$500K).

The Critical Question: When Do Sales Reps Add Value vs. Friction?

Value-Adding Sales Scenarios

- Complex implementation requirements needing custom configuration

- Multi-stakeholder decisions requiring consensus building

- Regulatory or compliance considerations demanding expert guidance

Friction-Creating Sales Scenarios

- Simple product evaluation where trials demonstrate value

- Standardized use cases with predictable setup

- Price-sensitive SMB buyers who are deterred by sales interactions

The reality: 97% of B2B buyers prefer to try before they buy rather than talk to sales first. Your sales process should align with this preference, rather than fighting against it.

Can you have a free trial and still be sales-led?

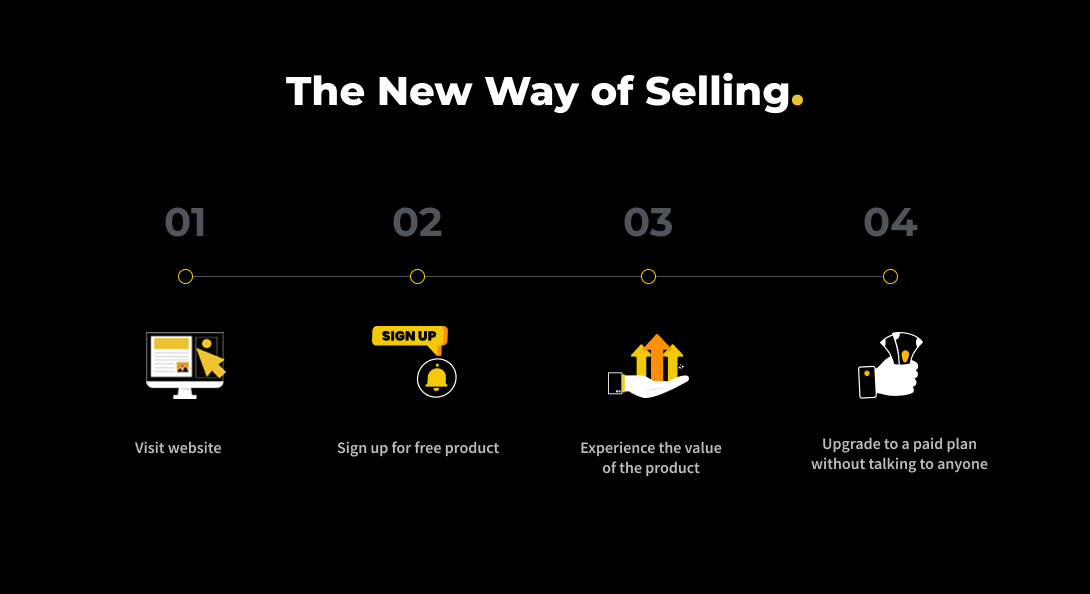

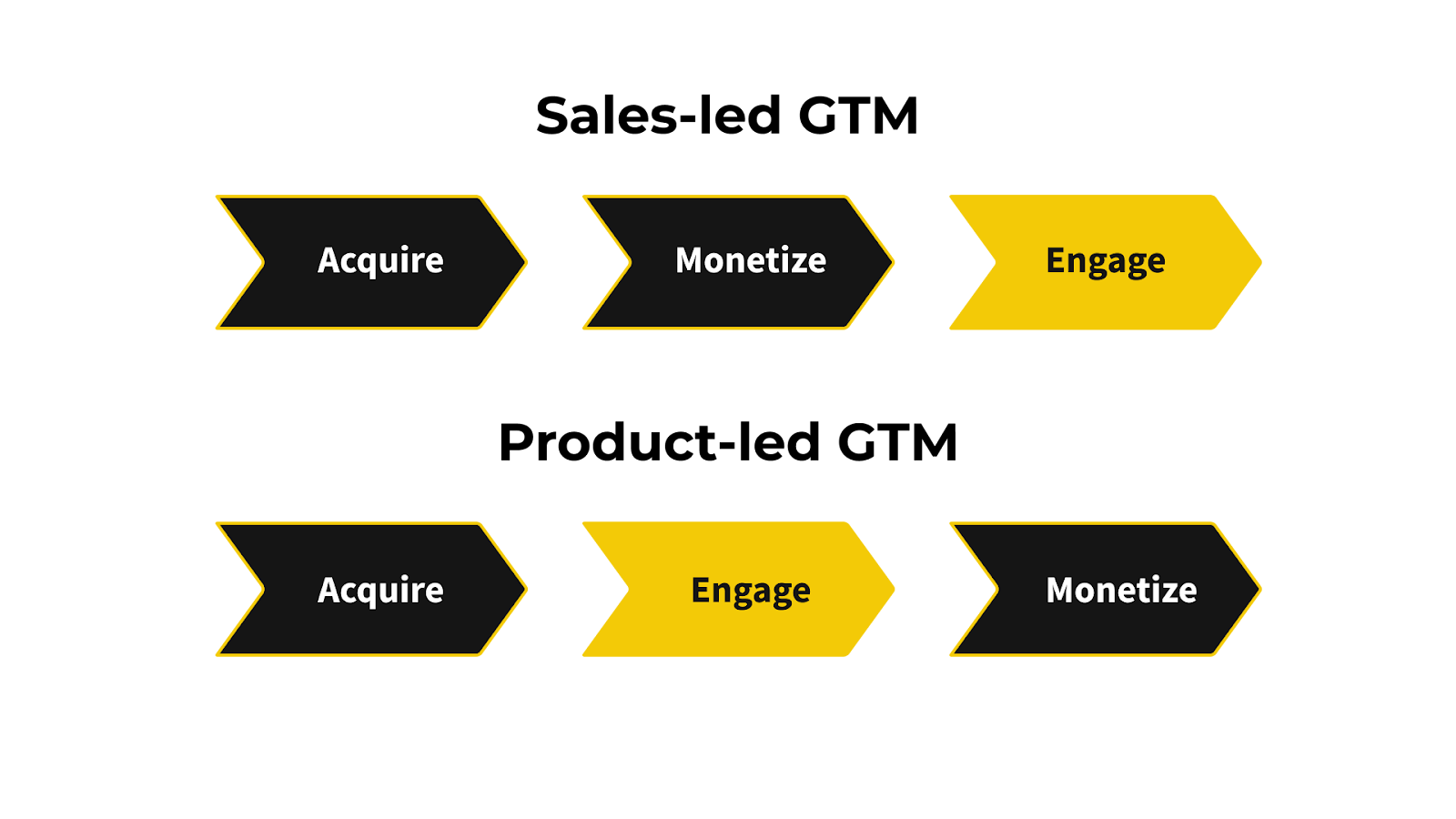

Absolutely. The main difference between a product-led vs a sales-led company comes down to how they sell.

A sales-led funnel is a conversion funnel.

That means once they acquire you on the website, the main focus is on monetizing you if you’re a good fit, then engaging and delivering on their value.

As you can see, this is a long process.

Sales-led companies that roll out a free trial often fall into this same approach without knowing it. They think they’re product-led, but then nobody on their team focuses on getting users to value. The free trial is simply a more cost-effective way to attract interested prospects and call them.

A product-led approach is all about serving engaging users and providing a significant amount of value upfront before making the sale. That’s why we wrote an entire book on Product-Led Onboarding. Because if you can’t get users to value, good luck. They’re not coming back a second time or buying from you.

You can easily identify whether you have a sales-led or product-led go-to-market motion by asking yourself, do you engage (aka provide value) your potential customers before trying to monetize them?

That said, I believe you can still have a call in your sales process and be product-led in a couple scenarios. For instance, when we speak with potential clients who apply to work with us, we help them clarify whether PLG is the right fit for their business. That’s insanely valuable and enables us to engage prospective clients and provide a ton of value before they decide to work with us as a client.

What does it really mean to be product-led

Becoming product-led is about showcasing your value and serving your users first.

Sales-led companies often rely on telling prospects about the product and then selling them on its benefits.

We’ll let you decide which approach you prefer.

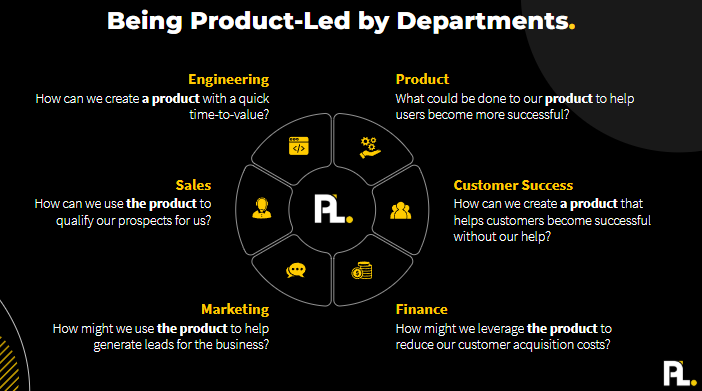

Does one team own PLG?

One of the most common misconceptions is that PLG is just a growth team. This is especially true for sales-led companies making the transition to a product-led organization because initially, that’s true. You should have a cross-collaborative growth team focused on rolling out Product-Led Growth (PLG). However, once the PLG motion is launched and operational, the goal is to build a product-led organization where every department approaches its tasks in a product-led way.

Now that we’re on the same page about what PLG is, why do it?

Part 2: The Compelling Case for Product-Led Growth

The more expensive it is for you to sell something, the more expensive it is to buy.

Product-led companies generate higher profits, operate more efficiently, and build defensible competitive moats.

Revenue Impact

25% Faster Sales Cycles

When prospects experience product value before sales conversations, deal velocity accelerates. Product-qualified leads convert 5-10x faster than marketing-qualified leads.

20-30% More Signups

When you launch a free offer, whether that’s a free trial or freemium model, you’ll typically see 20-30% more signups because it’s a low risk offer for a buyer to consider. It’s an easy yes. Signing up for a demo incurs a cost. In retail stores, you see this happen all the time. You’ll have many more prospects looking at clothes to buy versus those reaching out to sales to order something.

Higher-Margin Revenue

PLG revenue = no sales commissions. Higher margins. No cut taken. Your product sells itself.

Expansion Revenue Automation

PLG companies achieve a 30-50% reduction in support tickets through enhanced self-service capabilities, while maintaining higher customer satisfaction scores. The product automatically identifies and drives expansion opportunities based on usage patterns.

Note: Averages reflect our client observations and may not represent the broader SaaS market, as we primarily work with top-performing companies.

Cost Savings (What You Save)

44% Lower Customer Acquisition Cost

Traditional SaaS companies typically spend $900-$ 2,500 per customer on sales and marketing. PLG companies achieve similar results for $500-1,400.

Competitive Advantages: Why PLG Companies Win

Predictable Growth Engine

Product usage data creates more reliable revenue forecasting than traditional pipeline management. It’s easy to forecast and understand what your new MRR will be even halfway through the month.

Market Share in Neglected Segments

Sales-led companies abandon SMB markets due to poor unit economics. PLG companies profitably capture this entire segment.

Rapid Global Scale

Because your product is easily scalable, you can simply launch a new ad campaign in a new market and see how it performs. With modern AI translation tools, you can easily enter many new markets at once. That is something that would be extremely difficult with a sales team.

Superior Product Feedback

Direct usage data provides richer insights than filtered sales feedback. PLG companies ship features customers want, not what sales thinks they need.

Viral Growth

Product experiences create natural sharing mechanisms. Users become advocates through value, not sales relationships.

Recession Resistance

Self-serve models thrive when budgets tighten as users can try, buy, and expand without lengthy sales cycles. And because you’re more operationally efficient, you can offer a more competitive price while keeping higher margins.

Operational Efficiency

Compound vs. Linear Growth

Because your product is able to take on more as you scale, whether that’s onboarding more users, upgrading more of them, or expanding them, you’re able to add millions in new ARR without adding more headcount. Compare this to a sales-led organization where you need to add a new sales rep for every additional $500k in ARR you want to add. Not to mention, you have to hire, train, and manage them. And that typically requires you to invest a lot upfront before that new sales rep goes from a liability to an asset on the team.

Capital Efficiency

Requires less upfront investment in sales infrastructure, making it attractive to investors and conserving cash

Revenue Per Employee

68.4% of SaaS companies generate under $100K in revenue per employee (RPE). Top performers achieve $300K+ RPE. PLG companies consistently hit higher efficiency through automation.

The Tally.so Example: Five-person team generating $3M ARR ($600K RPE) through pure product-led growth.

Your Product as Your Best Employee

Think of PLG transformation as hiring your most effective team member - one that works 24/7, never takes vacation, and scales infinitely:

- Best Salesperson: Demonstrates value instantly without scheduling conflicts

- Best Customer Success Rep: Provides immediate support and guidance

- Best Marketing Channel: Converts prospects through direct experience

- Best Data Analyst: Tracks every interaction and optimizes continuously

This "employee" is the single highest-leverage asset your business can create. It works 24/7, scales without adding headcount, and turns every dollar invested into 10 or more times its value. Unlike a hire, it doesn’t need sleep, meetings, or management - it just grows your business.

Now this is why you should consider PLG.

Yet, here’s the truth.

Sales-led companies are easy to get started but hard to scale, while product-led companies are hard to get started but easier to scale.

So this isn’t going to be a walk in the park…

Part 3: Common Challenges and How to Overcome Them

Why 85% of PLG Transformations Fail

Most companies fail at PLG transformation within 18 months, not because PLG doesn’t work, but because they make three critical implementation mistakes that doom the effort from the start.

The Three Fatal Mistakes:

- Fragmented Implementation - Companies focus on isolated tactics (better onboarding, new pricing) without an integrated strategy

- No Clear PLG Champion - Committee-driven approaches lack focused execution and accountability

- Product-Sales Conflict - Sales teams resist PLG, creating internal friction that kills momentum

Our approach eliminates these failure points through a systematic implementation with clear success metrics.

The 6 Most Expensive Mistakes to Avoid

The "Free Trial Trap"

Mistake: Adding free trials without changing underlying business processes or user experience.

Solution: Ensure trials demonstrate clear value and include natural upgrade paths rather than just time-limited access.

Premature Monetization

Mistake: Trying to monetize before users experience meaningful product value.

Solution: Focus first on delivering clear "aha moments," then optimize conversion after value demonstration.

Sales Team Resistance

Mistake: Inadequate change management creates internal resistance and PLG-sales conflicts.

Solution: Frame PLG as sales enablement rather than sales replacement. Show how product-qualified leads convert faster and with higher close rates.

Analytics Blindness

Mistake: Attempting PLG optimization without comprehensive user behavior tracking.

Solution: Invest heavily in analytics infrastructure before optimizing conversion flows. You can't improve what you can't measure.

Lack of Executive Patience

Mistake: Expecting immediate results from PLG transformation without allowing time for implementation and optimization.

Solution: Set realistic timelines (12-24 months for significant results) and focus on leading indicators rather than just revenue metrics.

Missing Organizational Capabilities

Weak Product & Engineering Capability

Traditional Challenge: Most sales-led companies have weak product teams that take orders and deliver on what the sales team has promised to new customers. PLG success demands strong product and engineering capabilities. You need teams that can ship quickly and iterate based on user feedback, but also pushback, and have a strong backbone when it comes to what we decide to build. Because every new feature you add increases the potential complexity of a user getting value.

PLG Solution: Ensure you have a C-level executive who understands how to run both a product and engineering team to simplify delivery.

Product Marketing Excellence

Traditional Challenge: Most B2B companies optimize messaging for buyers (executives) rather than users (employees). As a result, a sales-led homepage is often much shorter and can get away with vague customer benefit statements that the sales rep can personalize to each prospect. You can’t do that with a product-led business as users won’t even bother signing up.

PLG Solution: Develop an irresistible free offer that communicates the value you’re going to get from using the product.

2. User Research Beyond the Buyer

Traditional Challenge: Sales-led companies understand buyer pain points but not daily user workflows.

PLG Solution: Implement continuous user research focused on product experience and workflow integration.

3. Pricing Strategy Revolution

As one founder noted: “Our pricing strategy is asking for the most money we can upfront and then downselling if it’s too much for the buyer."

PLG Solution: Systematic value-based pricing aligned with product usage patterns and natural upgrade triggers.

4. Data-Driven Growth Processes

Traditional Challenge: Growth decisions are based on sales feedback rather than product usage data.

PLG Solution: Implement growth experimentation frameworks with statistical rigor and clear success metrics.

Executive Commitment: The Make-or-Break Factor

Executive commitment represents the most critical success factor, with failed implementations typically lacking CEO-level championship throughout the transformation process.

Common Executive Concerns and Responses

"Will this cannibalize our existing sales?"

- Reality: Proper segmentation protects high-value sales while capturing neglected segments. For example, letting small companies (1–10 employees) self-serve, while larger accounts continue through your sales-led process.

- Evidence: Zoom, Slack, and HubSpot grew existing sales while still having a PLG motion

"Our product is too complex for self-service."

- Reality: Complexity can be progressively revealed through better onboarding

- Evidence: Even complex platforms like HubSpot, Amplitude, and Datadog achieve high self-service adoption

"We can't afford the development investment."

- Reality: ROI typically exceeds 200-400% over 3 years with proper implementation

- Evidence: Average payback period of 12-18 months for comprehensive PLG transformation

Now, if I haven’t scared you away yet with those common challenges, I’ve got some more hard-hitting questions for you to answer.

Part 4: Are You Actually Ready for PLG?

Before investing millions in PLG transformation, you need to be brutally honest about your readiness. Most PLG failures stem from companies rushing into implementation without a proper foundation. This assessment framework, based on an analysis of 446 SaaS companies, identifies the six critical readiness dimensions that predict PLG success.

Why These 6 Categories Determine PLG Success

After analyzing hundreds of successful and failed PLG transformations, six categories consistently emerge as predictive factors:

- Market Readiness determines if your customers will adopt self-service purchasing

- Team Readiness ensures you can execute PLG implementation effectively

- Leadership Buy-In provides the sustained commitment needed for transformation

- Product Readiness validates whether your product can deliver value autonomously

- Tooling Readiness confirms you can measure and optimize PLG performance

- Strategic Alignment ensures PLG supports rather than conflicts with your vision

You can take the ProductLed Readiness Assessment here or go through a high-level version of the questions below.

Category 1: Market Readiness

Do your buyers want to speak with a sales representative before buying?

🟢 Strong PLG Fit: Buyers expect to try before talking to sales; purchase decisions happen quickly (days/weeks)

🟡 Mixed Signals: Varies by segment - some prefer trials, others want demos

🔴 Sales-Led Market: Buyers prefer demos first; complex procurement with multiple stakeholders

Category 2: Team Readiness

Can your team execute PLG effectively?

🟢 Ready to Execute: PLG-experienced talent hired; cross-functional growth pod active; weekly experimentation

🟡 Learning Mode: Some PLG experience; partial cross-functional team; monthly experiments

🔴 Skill Gaps: No PLG experience; siloed teams; rarely/never experiment

Category 3: Leadership Buy-In

Is leadership fully committed to PLG success?

🟢 Full Commitment: PLG communicated as top strategy + dedicated budget + appointed leader

🟡 Moderate Support: 1-2 leadership actions taken; viewed as important but not urgent

🔴 Limited Support: PLG discussed, but no concrete actions or resource allocation

Category 4: Product Readiness

Can users reach value without human help?

🟢 Self-Service Ready: Users reach value within first session; immediate "aha moment"

🟡 Quick Value: Users reach value within the first week with minimal guidance

🔴 Human-Dependent: Users need sales/CS help to achieve value; complex setup required

Category 5: Tooling Readiness

Can you measure and optimize PLG performance?

🟢 Analytics-Driven: Professional product analytics (Mixpanel/Amplitude); product data drives GTM decisions

🟡 Basic Tracking: In-house dashboards; some product data usage for decisions

🔴 No Analytics: Google Analytics only; GTM decisions based on sales feedback

Category 6: Strategic Alignment

Does PLG align with your long-term vision?

🟢 Strategic Imperative: Clear 5-10 year vision; PLG is the only scalable path to achieve it

🟡 Strategic Option: Rough directional vision; PLG accelerates but isn't the only path

🔴 Misaligned: Quarter-to-quarter focus; high-touch model by design

Your Next Steps Based on Readiness

🟢 PLG Ready (5-6 Green categories)

- Action: Begin implementation immediately

- Timeline: 6-12 months to meaningful revenue

🟡 PLG Potential (3-4 Green categories)

- Action: Address the low-hanging fruit and then implement

- Timeline: 3-6 months prep + 12-18 months implementation

🔴 PLG Preparation (3+ Red categories)

- Action: Build foundational capabilities first

- Timeline: 6-12 months preparation + transformation

Quick Gap Solutions

Market Gap: Test a free offer (e.g., “request a free trial”) and manually onboard users through the product to validate demand for self-serve.

Team Experience Gap: Hire a ProductLed Implementer to close capability gaps and kickstart execution.

Leadership Gap: Align the leadership team around the PLG strategy by showcasing its long-term value and assigning ownership.

Product Value Gap: Simplify onboarding and the core user journey to help users reach value faster without any hand holding.

Tooling Gap: Implement product analytics (e.g., Mixpanel, Amplitude) to identify and fix drop-offs in the user journey.

Strategic Alignment Gap: Ensure PLG aligns with your long-term vision.

Now, assuming you’re ready to implement PLG, let’s talk numbers.

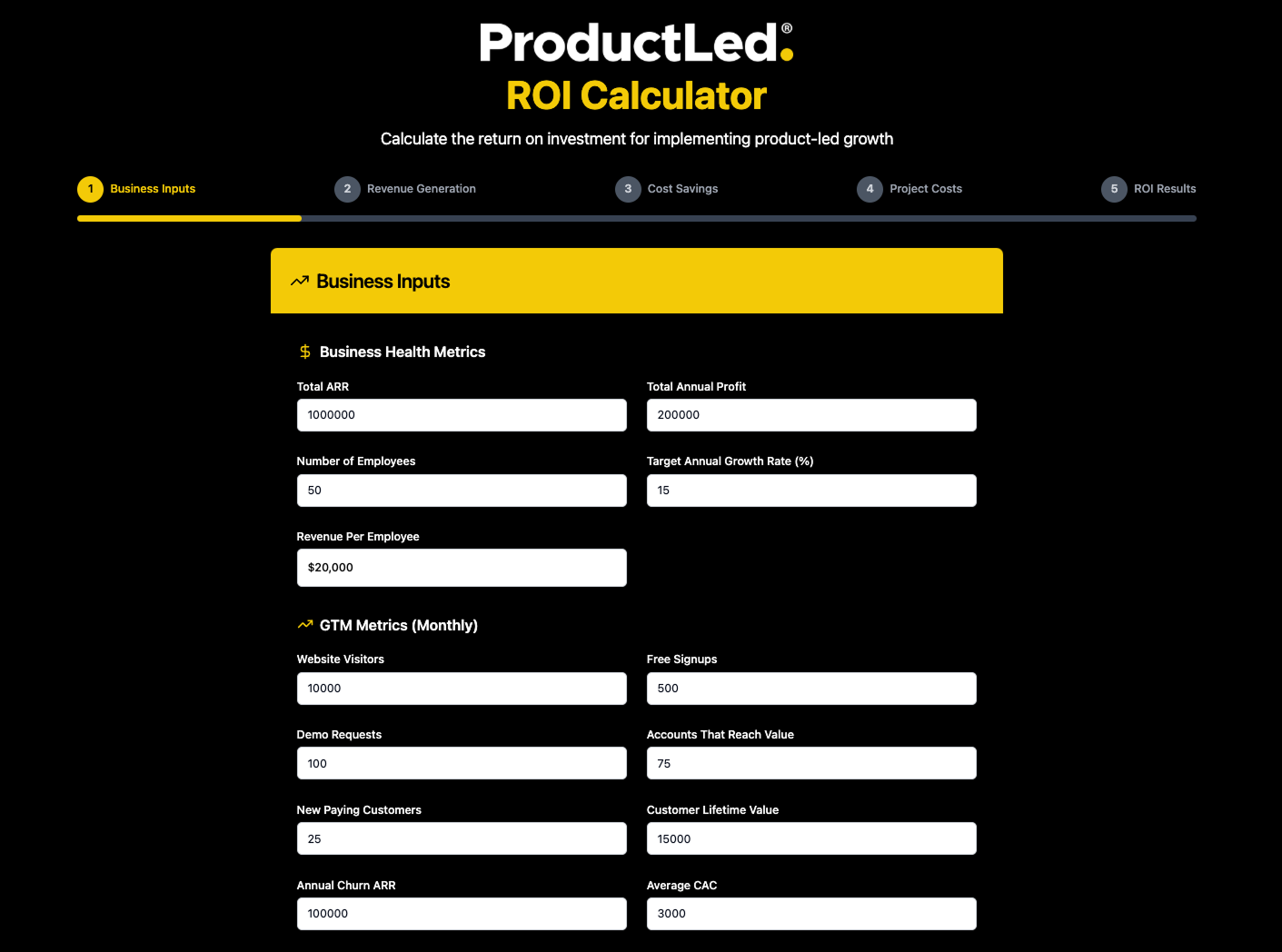

Part 5: Your Product-Led Growth ROI Calculator

Building a business case for PLG is relatively straightforward if you have the right inputs.

This is the best formula for identifying what your ROI will be:

Total Value = Revenue Impact + Cost Savings - Total Investment

Building a bulletproof PLG business case requires the right inputs and realistic projections. This framework gives you both.

For a high-level overview of your ROI with product-led growth, use your free PLG ROI Calculator

However, if you’re looking to roll up your sleeves and get the exact ROI and narrow down the assumptions made, here’s how you can create your own CFO-approved business case.

Start with getting the right data.

1. Business Inputs

To build a solid business case, we need to gather some information first.

Business Health Metrics

- Total ARR: $________

- Annual Growth Rate: _______%

- Current Profit: $________

- Revenue per Employee: $________ (ARR ÷ Employee Count)

GTM Metrics (based on last month)

- Visitors on the site

- # of free signups

- # of demos

- # of accounts that get to value

- # of accounts that upgrade (new customers)

- Lifetime value of customers

- Annual churn ARR

- Average CAC

Team

- Do you have a PL Implementer yet? Visit our pricing page to understand how much this will be.

- Do you already have a product or UX designer?

- Do you have a Growth PM or Head of PLG?

Tools

- Do you have product analytics in place?

- Do you have a user onboarding tool?

- Do you have an experimentation tool?

- Do you have a comms and support tool? (i.e. zendesk, intercom, customer.io)

The answers to these questions will help you identify where you are in your journey and some of the investments you’ll need to consider.

Now we can use this data as a baseline for understanding the potential revenue impact.

2. Revenue Impact (What You Gain)

These are the primary revenue drivers of PLG.

Self-Serve Revenue Engine

- What it is: Revenue from customers who buy without sales involvement

- Typical impact: 3-5x improvement in free-to-paid conversion rates

- Your opportunity: Monthly signups × improved conversion × ACV × 12

Product-Led Sales Acceleration

- What it is: Faster, higher-converting sales cycles for product-qualified leads

- Typical impact: 25% faster sales cycles, 30-60% higher close rates

- Your opportunity: Current pipeline × velocity improvement × close rate improvement

Automatic Expansion Revenue

- What it is: Product-triggered upsells based on usage patterns

- Typical impact: 15-30% of PLG customers expand within 12 months

- Your opportunity: PLG customer base × expansion rate × average expansion value

Traffic and Lead Generation Boost

- What it is: More signups from same traffic due to try-before-buy preference

- Typical impact: 20-30% increase in conversion from visitor to signup

- Your opportunity: Current monthly visitors × signup lift × conversion improvement

Conservative Revenue Impact Estimate

Annual Additional ARR: $1M - $5M (for companies with $10M+ ARR)

3. Cost Savings (What You Save)

These are the major cost reductions.

Sales Team Efficiency (35% average savings)

- What changes: Sales focuses on enterprise deals, not small accounts

- Your savings: Current sales cost × % time on SMB × efficiency gain

- Typical range: $200K - $800K annually

Customer Acquisition Cost Reduction (44% average)

- What changes: Self-serve customers cost less to acquire than sales-assisted

- Your savings: Current CAC × PLG customer volume × 44%

- Typical range: $500K - $1.5M annually

Support and Success Cost Reduction (40% average)

- What changes: Better onboarding reduces support tickets and manual handholding

- Your savings: Current support cost × reduction percentage

- Typical range: $150K - $400K annually

Conservative Cost Savings Estimate

Annual Savings: $850K - $2.7M (for companies with mature sales teams)

4. Total Investment (What You Pay)

These are essential investments to consider for Year 1.

PLG Implementation Partnership

- Strategic Guide: $5.5K/month - Framework and oversight

- ProductLed Implementer: $10K/month - Hands-on execution

- Integrated Team: $25K/month - Full-service transformation

- Annual range: $66K - $300K

💡 Most companies underinvest here but pay for it by having a lackluster PLG motion that doesn’t convert well.

Technology Stack

- Product analytics: $30K - $200K (Amplitude, Mixpanel)

- User onboarding: $20K - $60K (Userflow, Appcues)

- A/B testing: $15K - $50K (GrowthBook, Optimizely)

- Communication tools: $25K - $75K (Intercom, Customer.io)

- Annual range: $90K - $385K

💡 Most companies overspend here before fixing core product value delivery. Sequence matters.

Team Additions (Scale based on company size)

- Growth PM: $150K - $220K (Start here)

- Growth Engineer: $140K - $200K (Add in months 6-12)

- Head of Growth: $200K - $350K (Add at scale)

- Annual range: $150K - $770K

💡 Start lean. One strong Growth PM + part-time engineer can go a long way in Year 1.

3-Year Total Investment Range: $1M - $4.5M

Investment costs decrease over time as implementation services are reduced and systems mature

5. Total ROI

Your PLG ROI Scenarios

Context: ROI projections for sales-led B2B SaaS companies with $10M-$50M ARR, currently generating 0-5% self-serve revenue

What Drives These Results

Conservative Scenario: Small PLG motion (3x conversion improvement)

- Captures 15% of currently lost prospects through self-service

- Sales team focuses 40% more time on enterprise deals

- Basic automation reduces support costs by 30%

Moderate Scenario: Comprehensive PLG transformation (5x conversion improvement)

- Captures 30% of currently lost prospects + expands existing customers

- Sales becomes product-qualified lead focused with 50% efficiency gain

- Advanced onboarding and self-service reduces costs by 45%

Aggressive Scenario: Full product-led growth engine (8x conversion improvement)

- Captures 50% of lost prospects + viral growth mechanisms active

- Sales handles only enterprise deals with 60% efficiency improvement

- Automated expansion and support creates 55% cost reduction

CFO Summary Statement

"For sales-led SaaS companies with $15M+ ARR and significant inbound traffic, PLG investment of $1.5M - $3.5M over 3 years delivers $5M - $17.5M in combined revenue and cost benefits, representing 233-400% ROI with 12-18 month payback periods."

Part 6: How to Rollout PLG Step-by-Step

📊 TL;DR: Our proven ProductLed System has generated $1B+ in self-serve revenue across 400+ companies. Our approach minimizes risk while delivering measurable results every 90 days.

Here’s a high-level overview of the process:

Why 85% of PLG Transformations Fail

The Three Fatal Mistakes:

- Fragmented tactics without cohesive strategy (adding trials without changing processes)

- No dedicated owner - committee-driven approaches lack focused execution

- Sales resistance - PLG competes with rather than enhances existing sales

Our systematic approach eliminates these failure points through clear ownership, integrated strategy, and sales alignment.

The Battle-Tested 3-Phase System

Methodology proven with companies from $0 to $4B ARR.

Phase 1: Strategic Foundation (Months 1-3)

Building the PLG Framework That Scales

What We Deliver

- PLG Strategy Integration - How PLG accelerates your path to $100M+ ARR without cannibalizing existing sales

- Ideal User Definition - Precise ICP for self-serve segment based on behavioral data, not demographics

- Intentional Free Model - What to give away for free that demonstrates value while driving conversion

- Competitive Positioning - How PLG becomes your sustainable moat against larger, sales-led competitors

Example: $10M User Analytics Platform

Challenge: A Microsoft competitor that is giving away a comparable solution for free.

Solution: Identify where the company delivers outstanding value to their market.

Outcome: Develop a winning strategy, get crystal clear on who the ideal customer is, and design an intentional free model that will stand out in a crowded market.

Key Milestone:

Complete PLG blueprint with exact implementation roadmap - no guesswork, no fragmented tactics.

Phase 2: Self-Serve Revenue Engine (Months 4-10)

Turning Product Experience Into Revenue

What We Deliver

- Value-First Onboarding - Users reach "aha moment" within first session, not first week

- Conversion-Optimized Pricing - Usage-based models aligned with customer success patterns

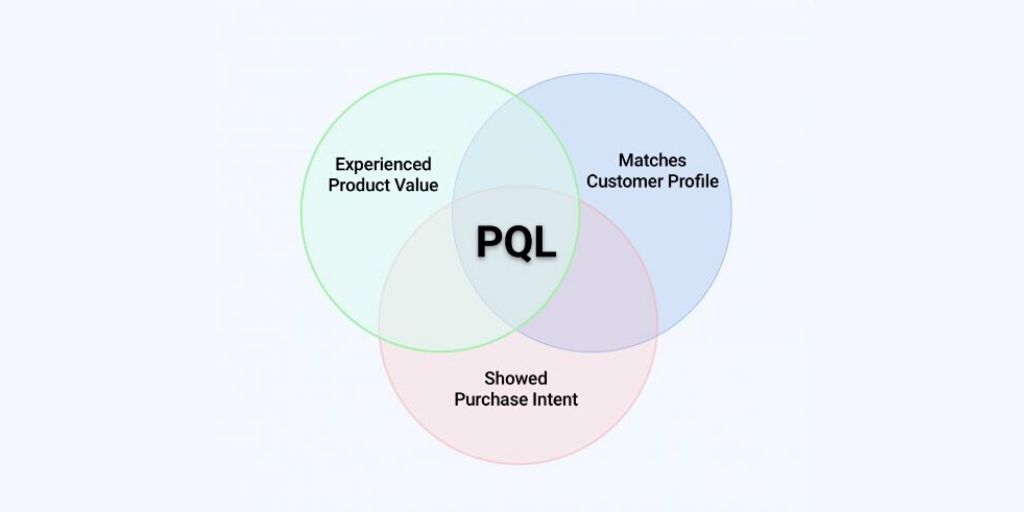

- Product-Qualified Lead (PQL) System - Automated identification of expansion-ready customers

- Sales-PLG Integration - Seamless handoffs that enhance rather than compete with sales

Our Systematic Process

- Willingness-to-Pay Research - Survey recent users to identify optimal price points

- Onboarding Optimization - Map out the entire user journey and remove friction while maintaining lead quality

- A/B Testing Framework - Data-driven optimization of every conversion touchpoint

- PQL Scoring Implementation - Behavioral triggers that identify ready-to-buy prospects

Example: $10M User Analytics Platform

Baseline: 2% free-to-paid conversion, $1,200 ACV

After Optimization: 5.8% conversion rate, $1,400 ACV

Result: 3x revenue increase from existing traffic

Key Milestone

Build a product that sells itself..

Phase 3: Scale & Optimization (Ongoing)

Building Your PLG Growth Machine

What We Deliver

- Expansion Revenue Automation - Product-triggered upsells based on usage patterns

- Viral Growth Mechanisms - Referral systems and sharing features that drive organic acquisition

- Advanced Personalization - Tailored experiences by user segment and behavior

- Multi-Product PLG - Cross-selling and upselling between product lines

Weekly Growth Experiments

Every week, we identify your biggest growth bottleneck and design targeted experiments:

- Conversion Optimization - Pricing tests, onboarding flow improvements, feature adoption

- Engagement Enhancement - Time-to-value reduction, feature discovery, user activation

- Expansion Revenue - Usage-based upgrade prompts, feature limitation strategies

Once we’ve implemented the full ProductLed System, we’ll refresh your GTM strategy each year by going through it again. The second and third times are much faster as we’re going to be building off of a strong foundation.

Part 7: How to Get Started - 4 Proven Transformation Strategies

Finding Your PLG Wedge: Where to Start

Strategy 1: SMB Segment Separation

Best for: Companies with mixed customer segments and high-touch sales for small deals.

Implementation: Create pure PLG path for 1-10 employee companies while maintaining enterprise sales process.

Example Application: Sales intelligence platform allows small businesses to self-serve while enterprise customers get dedicated sales support for complex integrations.

Strategy 2: Product-Led Expansion

Best for: Companies with strong existing customer relationships but manual expansion processes.

Implementation: Automate upselling based on usage patterns rather than sales rep outreach.

Example Application: Project management tool automatically suggests team plan upgrades when individual users hit collaboration limits.

Strategy 3: Geographic Market Entry

Best for: Companies expanding internationally where sales infrastructure doesn't exist.

Implementation: Launch PLG motion in new markets while maintaining sales-led approach domestically.

Example Application: US-based CRM launches self-service version in European markets before building local sales teams.

Strategy 4: Product Line Extension

Best for: Companies launching adjacent products or simplified versions of complex solutions.

Implementation: Create PLG motion for new, simpler products while maintaining sales process for core platform.

Example Application: Enterprise security company launches PLG password manager while keeping complex security suite sales-led.

Part 8: Successful Product-led Transformations

When a $4B Enterprise Company and a 20-Year CRM Pioneer Both Choose PLG, You Know It Works

The best way to understand PLG's transformative power is through companies that successfully made the transition. Here are two vastly different success stories that prove PLG works across company sizes, industries, and business models.

Case Study 1: Boomi - From $4B Enterprise Sales to Product-Led Growth

How a Dell subsidiary doubled free-to-paid conversion while maintaining enterprise relationships

The Challenge: Enterprise Sales Model Hitting Growth Limits

Company Profile:

- Size: $4B+ revenue (Dell subsidiary)

- Product: Integration platform-as-a-service (iPaaS)

- Model: 100% enterprise sales-led with complex, lengthy sales cycles

- Problem: Consumption-based model wasn't capturing full market opportunity

The Breaking Point: When comparing consumption-based metrics to actual revenue, leadership realized they needed fundamental change. The market was clearly moving toward product-led growth, but Boomi was stuck in traditional enterprise sales mode.

The Transformation: Three-Pillar Strategic Approach

Pillar 1: "No Regrets" Experimentation Rather than betting the company on PLG, Boomi started with low-risk experiments that couldn't harm existing business. They began with a two-week product-led growth sprint focused on one clear goal: create a process to nurture free trials and boost conversions.

Pillar 2: Scalable Model Beyond Trials To go beyond basic trials, they developed multiple user-centric solutions: a pay-as-you-go model for diverse users, platform independence features, and a community-oriented knowledge base that made the product truly self-service and repeatable.

Pillar 3: Cross-Functional PLG Culture Boomi assembled a team with diverse backgrounds - "multi-instrumentalist" types from different industries and roles rather than traditional enterprise software veterans. This brought fresh perspectives essential for PLG thinking.

The Results: Doubling Performance While Protecting Enterprise

Quantified Outcomes:

- 🔥 Doubled free-to-paid conversion rate

- 🔥 10% of all customers now come from self-serve motion

- 🔥 Maintained existing enterprise sales performance

- 🔥 Created sustainable competitive moat in mid-market segment

Strategic Impact: The transformation was successful because of three key factors: strong leadership support with collective agreement on PLG direction, early wins that demonstrated value to stakeholders, and integrated learnings from proven PLG methodologies.

Key Lessons for Enterprise Companies

- Start with "No Regrets" Experiments - Begin with changes that can't harm existing business

- Leadership Alignment is Critical - Enterprise transformations require top-down commitment

- Don't Abandon Enterprise Sales - PLG complements rather than replaces complex sales for large deals

- Invest in Community and Self-Service - Enterprise users still want independence when possible

Case Study 2: Keap - 20-Year CRM Company Embraces PLG

How a mature sales-led company created self-service options without cannibalizing sales

The Challenge: Sales-Only Model Limiting Market Reach

Company Profile:

- Size: 20+ year established CRM and marketing automation company

- Product: All-in-one CRM, marketing automation, and payments platform

- Model: Exclusively sales-led with no self-service options

- Problem: Missing customers who didn't want to talk to sales representatives

The Reality Check: CEO Clate Mask realized: "A bunch of customers don't want to talk to sales reps, and we didn't have a way for them not to do that before." They had attempted free trials years earlier but failed due to poor execution.

The Transformation: Sales-Assisted PLG Approach

Strategic Decision: Rather than replacing sales entirely, Keap created a "free trial-assisted experience" that gave prospects choice in how they wanted to engage.

Implementation Focus:

- Self-Service Path: Prospects could explore and purchase without sales interaction

- Sales Support Available: For those who wanted guidance, sales remained accessible

- Process Optimization: Applied proven PLG frameworks to avoid previous trial mistakes

Cultural Shift: The transformation required helping the organization understand that "a free trial-assisted experience is different than how we had done a free trial years ago, which we didn't do successfully."

The Results: Capturing Previously Lost Market Segments

Business Impact:

- 🔥 Successfully launched self-service revenue stream

- 🔥 Captured customers who previously would have churned out of sales process

- 🔥 Maintained sales team effectiveness for complex deals

- 🔥 Expanded addressable market without cannibalizing existing revenue

Customer Experience Improvement: The new model solved a fundamental customer experience problem - giving prospects the buying experience they preferred rather than forcing them into a single sales-driven path.

Key Lessons for Mature SaaS Companies

- Previous PLG Failures Don't Predict Future Success - Poor execution, not PLG itself, causes failures

- Sales-Assisted PLG Works - You don't have to choose between sales and product-led approaches

- Customer Choice Drives Revenue - Let prospects choose their preferred buying experience

- Systematic Implementation Matters - Following proven frameworks prevents repeat mistakes

What Both Transformations Prove

1. PLG Works Across Company Sizes and Stages

- Boomi: $4B enterprise subsidiary successfully implemented PLG

- Keap: 20-year mature company added PLG without disrupting existing sales

2. PLG Enhances Rather Than Replaces Sales

Both companies maintained their sales teams while adding self-service options. PLG captured new market segments rather than cannibalizing existing revenue.

3. Leadership Commitment Drives Success

Both transformations succeeded because of "strong leadership support" and "collective agreement on PLG direction." Half-hearted commitments fail.

4. Systematic Implementation Prevents Failures

Rather than DIY approaches, both companies used proven methodologies and expert guidance to avoid common PLG pitfalls.

5. Results Compound Over Time

Initial improvements in conversion rates and customer acquisition create sustainable competitive advantages that compound quarterly.

Your PLG Transformation Starts Here

These case studies prove that any B2B SaaS company can successfully implement PLG with the right approach. The question isn't whether PLG will work for your business—it's whether you'll implement it systematically or struggle with trial-and-error.

Ready to write your own PLG success story?

How We Help Companies Make the Shift From Sales-Led to Product-Led

Our Implementation Approach: Built for Success

Dedicated PLG Implementer

Not just consulting. Not just strategy. Hands-on execution.

Your ProductLed Implementer works inside your company as an embedded team member:

- Weekly strategy sessions with leadership team

- Daily execution with product and marketing teams

- Real-time optimization based on user data and feedback

- Direct responsibility for PLG revenue outcomes

Proven Team Structure

- Months 1-3: Leadership team + PLG Implementer (strategy and planning)

- Months 4-8: Go-to-market team + PLG Implementer (build and launch)

- Months 9+: Growth team + PLG Implementer (optimize and scale)

Risk Mitigation

- Phase-gated approach - Clear go/no-go decisions at each phase

- Baseline protection - Existing sales performance remains untouched

- Data-driven decisions - Every change backed by statistical significance

- Cultural alignment - Sales team trained on PLG lead characteristics and value

Why Companies Choose Our Approach

1. Proven Track Record

89% client retention rate with average implementations generating 250-400% ROI within 24 months.

2. Risk-Minimized Implementation

No "big bang" launches. We start with low-risk experiments and scale what works.

3. Sales Team Alignment

PLG enhances sales rather than competing. Better qualified leads, shorter sales cycles, higher close rates.

4. Sustainable Competitive Advantage

Product-led companies grow 2-3x faster and achieve higher valuations than sales-led peers.

The companies that win in the next decade will be those that master product-led growth today. The question isn't whether you'll eventually implement PLG—it's whether you'll be a first-mover or follower.

Ready to transform your SaaS growth engine?

Conclusion: Your PLG Transformation Starts Now

Product-Led Growth isn't optional anymore - it's how B2B software gets bought and sold.

The companies that will dominate your market in 3 years will be those that master PLG today. The question isn't whether you'll eventually need PLG—it's whether you'll be a first-mover capturing market share or a follower scrambling to catch up.

Your Three Critical Decisions

- How product-led should you be? Find your optimal position on the PLG spectrum

- What's your readiness level? Honestly assess your current capabilities

- How are you going to get started with PLG? Are you going to learn by trial and error or get some help along the way.

Take Action Today

Complete your PLG readiness assessment → Take Assessment

Calculate your specific ROI opportunity → Use Calculator

Explore implementation options → Schedule Strategy Session

The evidence is overwhelming. PLG reduces costs, increases efficiency, and creates sustainable competitive advantages. Companies that delay this transformation risk being left behind by more agile competitors.

Ready to transform your SaaS growth engine? The question isn't whether you can afford to invest in PLG—it's whether you can afford not to.