Identifying value metrics and ensuring they align with your pricing strategy can be the difference between struggles and success.

With a product-led company, you must choose the right pricing metrics if you want your business to thrive.

I want to help remove some of the confusion surrounding value metrics and pricing metrics so that you can select your pricing metric with confidence and get your executive team on board.

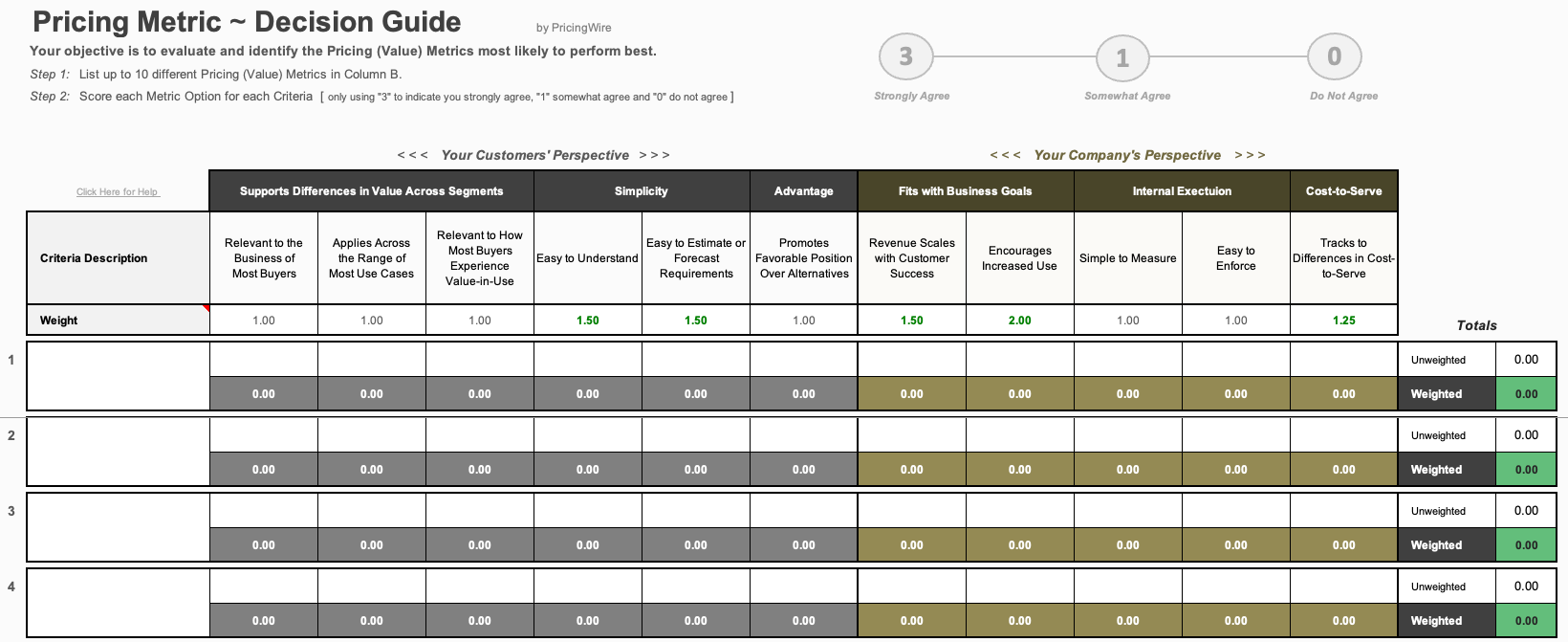

You'll need to download the Pricing Metric Decision Guide to follow along with the activity.

Watch the video below or continue reading for more information.

What are Value Metrics?

A value metric is the way you measure value exchange in your product.

Your value metrics are vital in how you price your product, set up your product metrics, and build your team. But what the heck does it look like?

- For a video platform like Wistia, a value metric could be the number of videos uploaded.

- For a communication application like Slack, a value metric could be the number of messages sent.

- For a payment processing platform like PayPal, a value metric could be the amount of revenue generated.

Why are value metrics so important?

Confusing value metrics and pricing metrics is easily done. So, let’s clear up some of the confusion surrounding the two.

A value metric is something that a customer or prospect associates value with. They view that aspect of your product as valuable and it is part of the reason why they want to do business with you.

A pricing metric could be considered a value metric. However, that’s just one piece of the puzzle. You can’t determine pricing metrics on a whim. It must be a strategic decision.

A pricing metric is when a unit-of-measure changes and if your customer consumes or uses more of your product, they pay you more. If they consume or use less of it, they pay you less.

5 Signs you’ve got your pricing metrics wrong

Choosing pricing metrics that will perform best is critical. Get your pricing metrics right, and you could see a jump in sales, customer retention, and sustainability for your product, SaaS, technology business, or software.

Get your pricing metrics wrong, and your business could suffer. And in this sense of the word, suffering could mean reduced sales and high customer churn.

Here are five signs that your pricing metrics aren’t performing as well as they should:

1. Low conversion – Close–Win Rate

2. Increasing / Long Sales Cycle and High CAC

3. Decreasing or Low ACV / ARPC Expansion

4. Decreasing or Weak Retention / High Churn

5. Decreasing or Low Customer Lifetime Value (CLV)

Do you notice a common thread through each of these five signs?

As you can see, each of these aspects is on a downward trajectory. That’s not what you want. You want all of these things to be going up. To increase and grow. The more that are increasing, the more success you’re having.

If things are not performing as well as you hoped they would, it’s time to take a closer look at your pricing metrics.

How to identify the right pricing metric

If you’ve looked at the five signs listed above and you think that you’ve got your pricing metric wrong in some way or another, there is a way to turn things around. And it doesn’t take nearly as much effort as most people believe.

You can do tests to check your existing approach or re-direct your thinking around your existing approach.

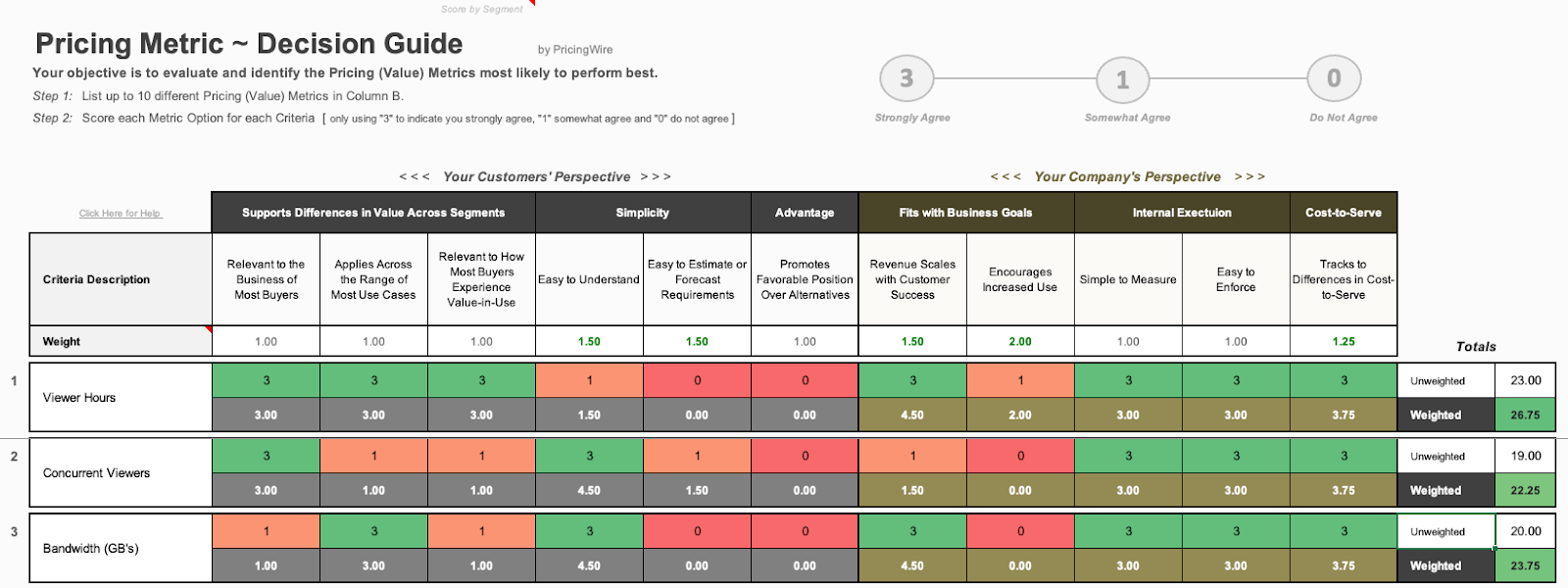

Using this Decision Guide will help you to evaluate and identify the Pricing (Value) Metrics most likely to perform best. You can download the template here.

At first, it may seem a little confusing, so let me break it down for you.

Along the top row are the questions to ask yourself about the options you list in Column B.

In Column B, you can list up to 10 different pricing (value) metrics.

Capture any possible pricing metric that comes to mind (there’s extra space at the bottom of the table if you come up with more than 10 pricing metrics).

Pricing metrics to consider

There are many different pricing metrics you can use.

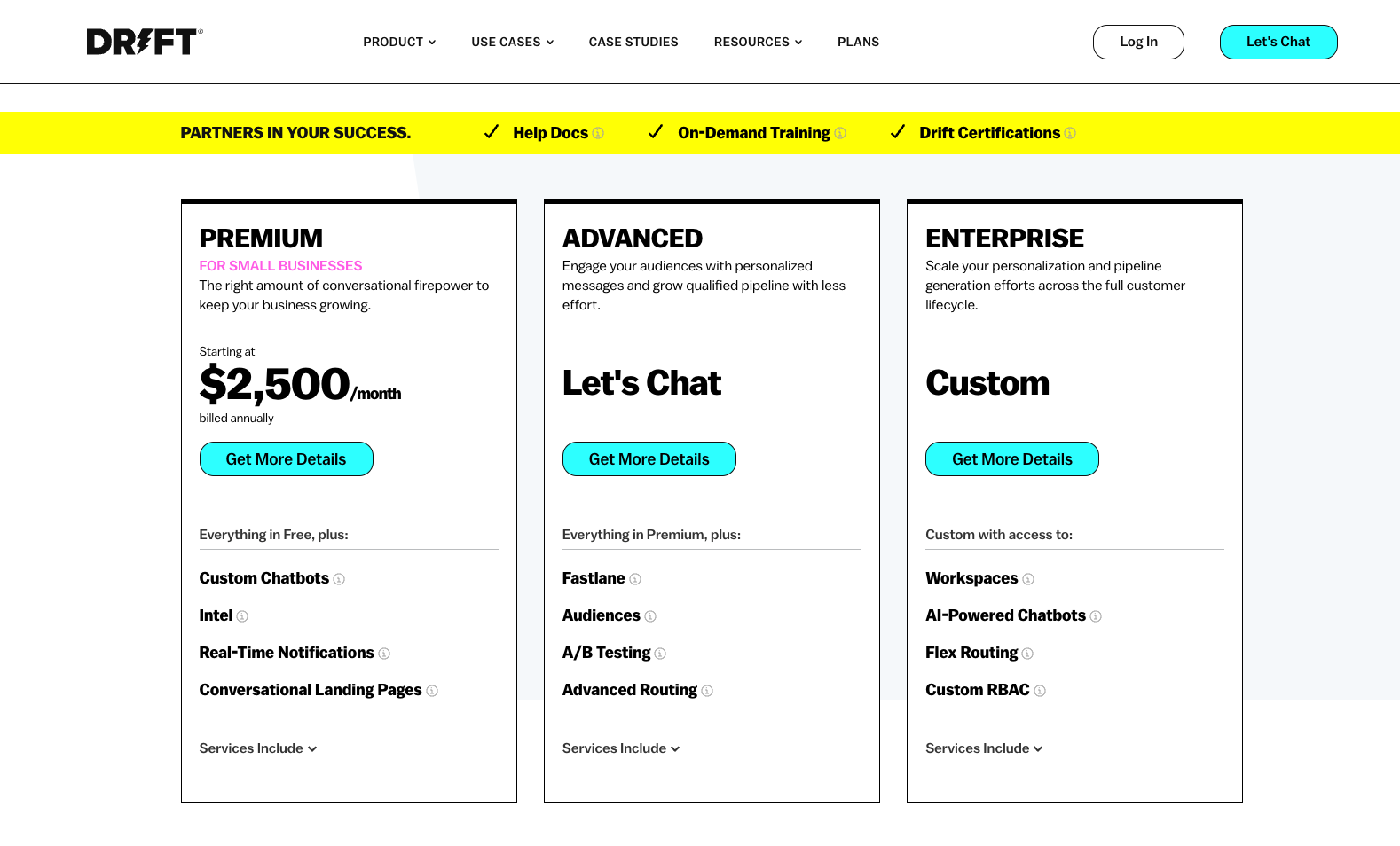

Take a look at Drift’s pricing, for instance:

They have segmented their plans into different price sections, allowing potential customers to see exactly what they get for their money.

Customers can also see what special features or benefits of the platform they’ll miss out on if they choose the free or standard version, for example. Of course, the more a customer pays for a plan, the more features and metrics they get access to.

It’s important to use your metrics and pricing plans to reinforce the value and impact your solution provides — and Drift does this perfectly.

Here are some more examples of pricing metrics that Drift uses:

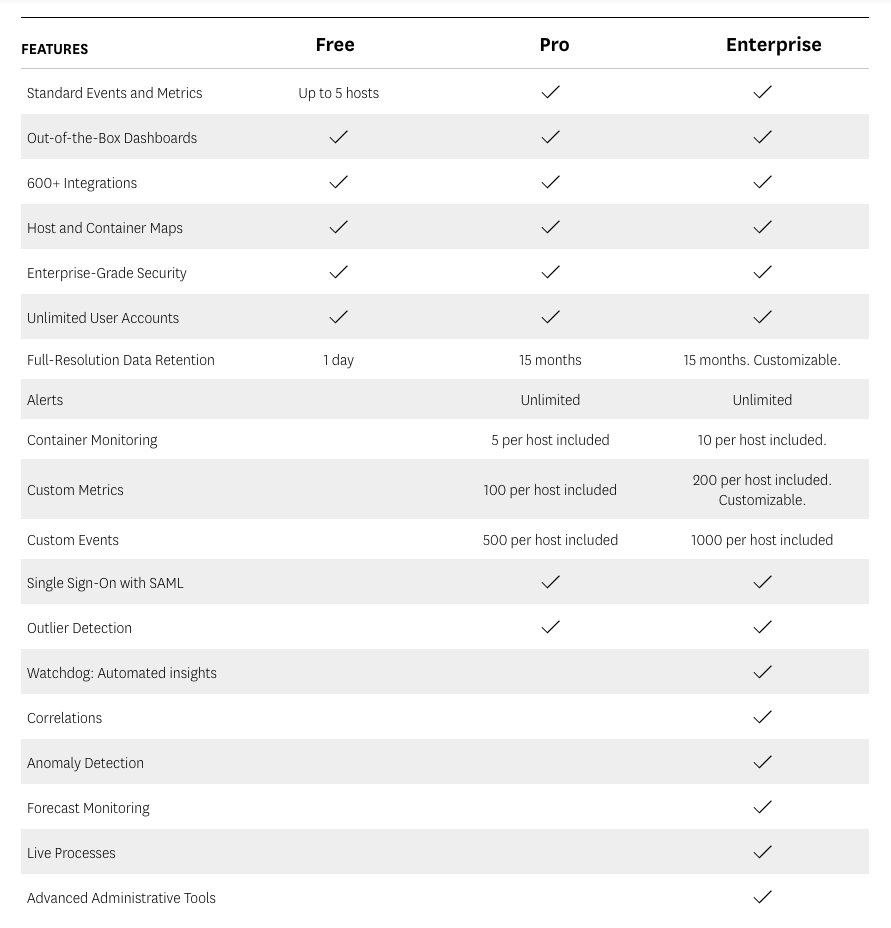

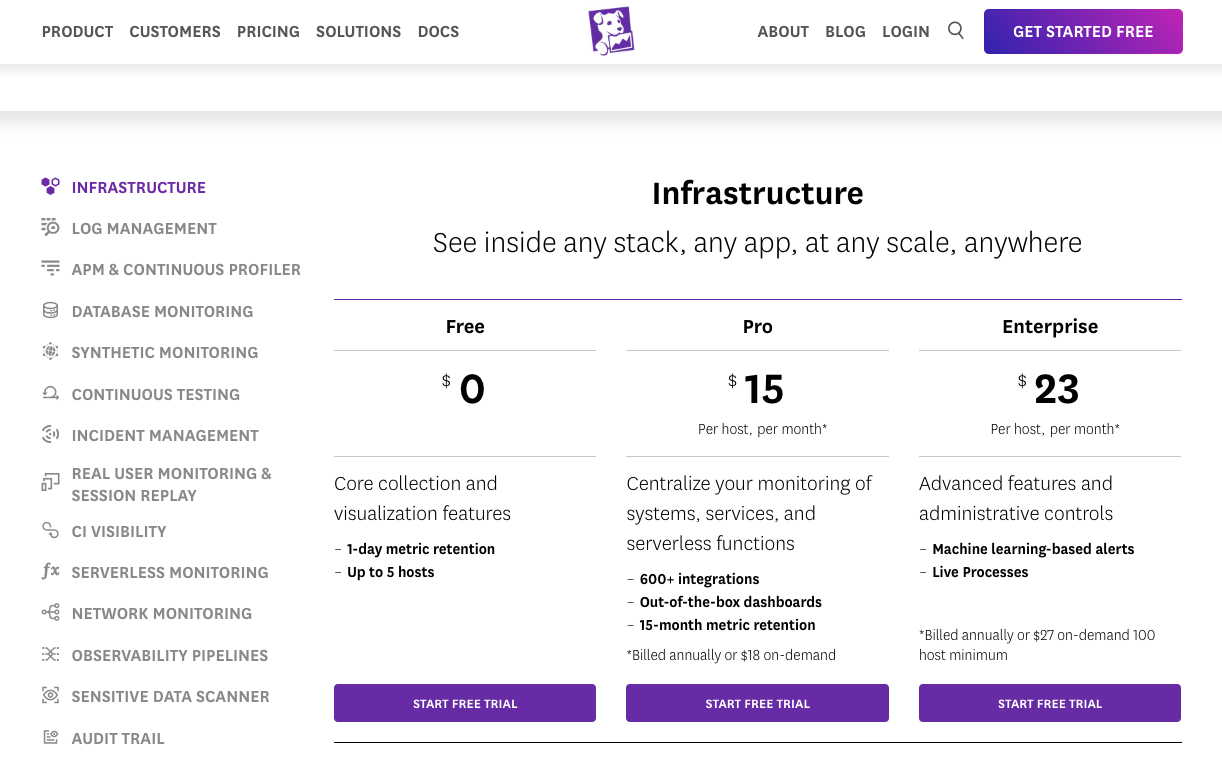

Let’s take a look at another example. This time it’s Datadog’s pricing metrics.

As you can see, Datadog takes a different approach. Many of their pricing plans are based on a monthly payment schedule starting at $15 per host, per month.

But they also have a ‘Log Management’ option, which shows how Datadog has made it as easy as possible for customers to not experience friction when deciding to follow through with the purchase or not. The offer makes sense to them. The pricing metric is right.

Different companies approach their pricing metrics differently. It’s all about what makes sense to them. You know your product better than anyone else, so start with what makes sense and tweak it from there.

Now, let’s get back to the Pricing Metric Decision Guide.

If you decide to download the blank version of the Pricing Metric Decision Guide, you will see instructions at the top of the table to help you complete it. It’s very simple, but I’ll walk you through it.

The first step is to list your pricing metrics in the left column (Column B).

Next, ask yourself the 11 questions along the Criteria Description row and score each metric option for each question.

I suggest scoring it out of 3.

So, if you strongly agree, you give it a score of “3”. If you somewhat agree, put “1” and if you do not agree, put a score of “0”.

Here’s a partial example of a completed Pricing Metric Decision Guide from a hypothetical video software solution company:

When asking yourself the 11 questions, you’ll notice that some of them are in the context of your customer's perspective while others should be considered from the company’s point of view.

If you notice more green (3) scores beneath the company’s perspective side of the table and fewer greens on the customer’s side, you may need to rethink your objectives and consider how you can better serve your customers.

Think about each of the questions carefully and make a case for your scores. This will help you identify the best value-based pricing metrics.

Why did you give each pricing metric that particular score?

Scoring a pricing metric with “3” means that you strongly agree and you’re confident that you can make a convincing case for that specific metric to meet the criteria described. It helps if you can provide some real-world examples, too.

A “1” indicates you somewhat agree. While you can make a case for it to meet the criteria description, you’ve reached a few roadblocks. Either you’re struggling to give concrete examples. Or, there are many different nuances across segments or personas to take into consideration.

If you give a pricing metric a score of “0” it’s because you do not agree, and you do not believe the criteria description applies to the metric being evaluated. You also have reasons for backing up your decision.

Who should decide what pricing metric to use?

So, who should be tasked with the pricing metric decision?

Well, whoever makes the pricing decisions in your organization should also be making the pricing metric decision. Or, at the very least, be involved in the decision-making process.

To achieve the best possible outcome, though, you should bring more members of your team on board to review pricing metrics. That way, you can all bounce ideas and opinions off one another and potentially come up with even better results.

Make better-informed pricing decisions

The Pricing Metric Decision Guide is designed to help you make better-informed monetization and pricing decisions.

Completing the Pricing Metric Decision Guide thoughtfully and with real purpose will help you feel more confident about your existing approach to how you choose pricing metrics. And, it can also reveal new opportunities you might have overlooked that may perform better than some (or all) of your existing pricing metrics.